Have you ever heard of ‘gun-to-the-head’ decision making?

You can use it in any aspect of your life. It’s not just a trading thing.

It’s a way of cutting through clouded judgement to give you the best chance of choosing a successful course of action.

Whenever you have a decision to make and there a number of options fighting for your attention simply imagine someone holding a gun to your head, cocking the trigger, and forcing you to make a choice.

The trick is they get to pull the trigger if your decision doesn’t eventually get you the result that you want!

It makes you drop any wishy-washy ideas you might have been considering in an instant. And keeps you focused on the high-probability ones instead.

Ask yourself a relevant question while you’re making any decision. Imagine how likely it is that you’ll be defying the gunman through your final choice…

Is this the most opportune market for me to trade today?

Will this choice from the restaurant’s menu keep me on my fitness plan?

Will a cultural tour of Florence give my young children a fun-filled holiday? Would they rather be on the beach with a bucket and spade instead this year?

You get the idea.

It might sound a bit daft but it’s amazing how this can add a whole new perspective to your thinking. Especially when it’s a decision you have to make on your own with no chance to discuss it with others.

So if you’re anything like me you’ve probably got all kinds of trading ideas, strategies and systems floating around in your brain.

But how many actually cut the mustard? How many of those strategies would you be comfortable putting forward if your life actually depended on it working?

Out of all the things I’ve seen and used in the markets over the years my pile of trusted methods would be surprisingly small.

But there’s one strategy that would be right up there with the best of them. And that’s using support and resistance to find potential reversal points in the market.

So let me show you how to do it. You know, just in case your life ever depends on a batch of trades!

First of all I’ll quickly review the concept we’re using…

The support and resistance levels we’re using are basically price zones the market has indicated to be significant. They are ‘balancing points’ between buyers and sellers – the tight bands of pricing at which previous dips and rallies fizzled out.

And the market keeps these prices tight in its memory bank.

If price action creeps back to them all eyes are peeled to see how they will be treated on this next occasion. Depending on what happens on the retest – whether price reverses or breaks through – they can indicate if buyers or sellers have the upper hand. And this can help keep you trading in-line with the underlying bias at work in the market.

We also need to keep in mind the concept of support becoming resistance (and vice versa). This is where a price level that provided significant resistance can actually become a reliable level of support once the market breaks through and establishes above it. Again, it’s down to the historical activity that took place in this area.

How to Take Reversal Trades Off Support and Resistance Levels

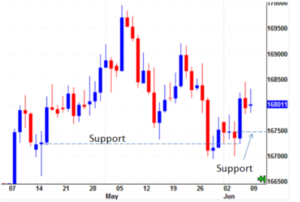

So here we are on the daily chart of a currency market.

I’ve labelled up some areas of interest:

The dashed line extends from the real-body of a spike-low candle from mid May.

That bar marked a significant low before the market rallied higher throughout May and into early June. We’re looking at that as a pivotal level in the market now. It’s a price zone which marked the baseline of recent Bullish dominance and one which should see some buying activity come in again if the market goes on to retest it. We’re looking for that level to offer support.

The circled area marks the point at which the market dropped down and tested our support.

You can see the buying interest come in and a real tussle going on between the bulls and the bears right on top of the dashed line.

It looks like the Bulls have secured a short-term victory – the market has popped up off support in recent days. And we now have a new secondary level of support to potentially trade off. Here it is:

We’re taking a new support level off the real-body of the candle that marked the most recent low.

We’ve also got that longer-term level of support sat right below so it should give us a good opportunity to look for a reversal trade. If the market drops back down to our new level of support we’ll look to BUY in anticipation of the market bouncing back higher.

And here’s what happens next:

You can see the market reverse straight off our new level of support before rocketing higher.

So how could you have traded this opportunity yourself?

I think there are three common ways to look at this. You can obviously be as creative as you like but these three ideas should give you a good starting point.

Three ways to trade the reversal

1.) Have a resting Buy order in the market that gets you into the trade on a retest of support.

Here’s how you might have set up your orders for this trade:

The Buy Limit order sits working away all on its own until the market hits your specified price and automatically gets you into the position. You might have had your limit order placed just above the level of support with a protective stop loss order below the very low of the candlestick.

It’s a more risky approach – you’re entering the market before any sign of buying in the market – but it’s a great way to play support and resistance levels if you can’t watch the market in real time.

And on this occasion you would have been rewarded with a 5:1 reward to risk trade within eight days – not too shabby from a trade on the daily chart!

2) Wait for buying to come in and buy a move higher. With this method you wait for signs of buying – confirmation that support or resistance is being observed by the market – before you commit yourself.

It’s a more conservative entry but you’ll usually give up some pricing advantage by getting in a way above support or below resistance.

Here’s how you might have done it:

You’ve seen signs of buying come in to the market at the support level on the blue up-candle. You might now try to get into the trade by buying a breakout above the high of the blue bar with a Buy-Stop entry order and your protective stop loss placed just below the low of the bar (and just below the support level for extra insurance!).

You didn’t get in at quite as good a price this time – it was around a 4:1 reward to risk trade – but you did have peace of mind that the market had already shown signs of the reversal before you jumped in.

3) Use intraday price action to fine-tune your entry. This method can give you incredible reward:risk ratios on your trades if you are able to watch the markets in real time.

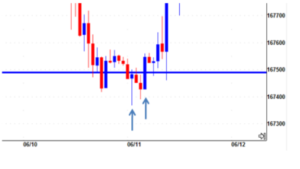

Here’s how you could have used the 60 minute chart to your advantage:

Here we see two strong bullish candlestick patterns within a couple of hours of each other right on the level of support.

First we see a bullish Doji pattern followed a few hours later by a Bullish Engulfing pattern. Taking an entry on a break above either of those bars would have given you 30 pips of risk if you kept your protective stop below the 60 minute bar lows.

Once your entry had been secured you could then use the daily chart to manage your exit. Taking the same exit point as the two examples above would have given you in excess of a 10:1 reward to risk trade.

Those are the opportunities that can really boost your account balance. And keep your head on your shoulders!

Be Prepared: Market Moving Data Coming This Week (London Time):

Wednesday 25th May

09:00 EUR German IFO Business Climate

15:00 CAD Interest Rate Decision

15:30 USD Crude Oil Inventories

Thursday 26th May

09:30 GBP GDP

13:30 USD Core Durable Goods

15:00 USD Pending Home Sales

Friday 27th May

13:30 USD GDP

15:30 USD Yellen Speaks

Monday 30th May

– no big reports

Tuesday 31st May

08:55 EUR German Unemployment change

10:00 EUR CPI

13:30 CAD GDP

15:00 USD CB Consumer Confidence

So have a play with that gun-to-the-head stuff. See if it adds a new slant to your decision making, especially when it comes to your trading.

Happy trading.