“Do not collect weapons or practice with weapons beyond what is useful”, said Miyamoto Musashi.

Think about what that might mean for a genuine warrior. Someone who stares down death on a daily basis…

He simply can’t afford to waste time messing around with things that won’t help him win his next fight. For the Samuari, a poor training routine, or the wrong choice of tools for the job, might result in a lost limb or even a loss of life.

But they were pretty good at spotting and then capitalising upon an edge the very best tools and weapons might give them.

In fact, they weren’t slow to sheathe their famous fancy swords as soon as gunpowder arrived on the scene. Flintlock rifles and cannon are what kept them alive when combat broke out during the sixteenth century!

Choose your weapon

Now for the trader, a poor choice of “weapon” is not going to be quite as catastrophic as having your arm lopped off in battle.

Although a trashed trading account certainly does deliver its own unique brand of pain!

But still, I am going to tread a little bit cautiously here…

You see, there are certain tools that you can invest in which can provide you with the kind of market insight available to the professionals.

So if it is possible you’re taking the trading equivalent of your sword to their gunfight you might like to hear about ways to step your game up a gear.

I’m going to tell you why I came to rely so heavily on one particular trading tool when I was a very active daytrader. This doesn’t necessarily mean it’ll be right for your own trading approach…

Before we move on, please do remember to only continue practicing with weapons that are useful… to YOU.

But I certainly found it useful.

This is hands-down the best trading tool for very active traders

Now the thing is, eSignal is a hugely flexible piece of software.

Traders from all disciplines can perfectly shape the workspace to suit the markets they follow and the way they trade.

Here are 5 very specific ways I’m sure active Forex traders can gain a genuine edge from using eSignal’s paid platform, over and above the everyday free charts and tools you might get from a broker.

1) Quality of Forex data: The first benefit eSignal delivers to the Forex trader is the most accurate representation of the true underlying market available. I’m sure you’re already aware that the currency markets are de-centralised (they don’t trade through a central exchange). Well, instead of being at the mercy of your broker and his single proprietary price feed, why not access a cumulative feed from over 200 contributing banks and institutions?

It’s the same data the professionals will be using and this is going to help you place much more accurate entry and stop loss orders when it comes to your own trading.

2) Volume at Price (VAP): One thing you’re certainly not going to be short of with eSignal is trading indicators! A huge portfolio is built straight into the platform. There’s an active marketplace for custom third-party indicators, and you can even design and set-up your very own. But remember today’s motto of only using weapons that are useful to you? Well, here’s one I think I’d struggle to trade the shorter timescales without. And I’ve never seen it directly offered by spread betting firms I’ve traded through here in the UK.

Could there be a particular reason they don’t want you to have it, I wonder?

VAP lets you see the horizontal distribution of trading volume. With Forex it’s tick volume (the number of trades) rather than the actual amount of currency. But this is still going to make support and resistance levels jump out like never before.

Here’s how it looks on your screen:

3) Access to currency Futures: Why limit yourself to analysing just the spot (cash) currency markets? Why not do what the professionals do and gain an extra insight from what’s going on in the currency futures? Do this and you’ll see a complete new dimension into the way institutions are positioning themselves. You’ll often pick up warning signs from the futures before the Spot markets actually move. Check out the CME (Chicago Mercantile Exchange) Forex futures – the data is all available directly from your eSignal platform.

4) Point & Figure Charts: Here’s another incredibly useful chart format you get with eSignal that I’ve never seen offered directly through UK brokers. Point and figure is as old as the hills but delivers the cleanest and most visually impacting overview of financial markets. You can clearly see areas of distribution and accumulation and obvious breakout points leap off the screen.

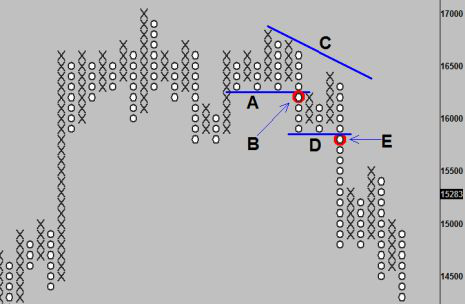

I’ve marked up a GBP/USD chart here so you can get an idea of what P&F can show you:

GBP/USD Point & Figure – (100pip box-size, 3 box reversal)

A: Clear support level

B: Sell signal on break of support

C: Down-trend line offers resistance.

D: Another clear support level

E: Another sell signal on break of support

5) Bar/Tick replay feature: This is a nice little feature build into every single chart you open on eSignal… ever notice a strange but potentially lucrative new pattern you’d like to practice trading? Looking for a way to sharpen your steel while the markets are quiet? This feature lets you replay real market data on a bar-by-bar, or even a tick-by-tick basis. It’s the perfect way to practice and develop your skills in a realistic but zero-risk environment.

So there are five ways you might benefit immediately from a premium trading tool like eSignal.

But of course, it still comes down to personal choice in the end…

You might find ways you can make even better use of it in your own trading. Or you might find you don’t have anything to gain at all. But you’ll never know unless you give things a try!

Here’s a link to the free trial for eSignal if you wanted to take a look.

Be Prepared: Market Moving Data Coming This Week (London Time):

Wednesday 14th June:

09:30 GBP Average Earnings Index

09:30 GBP Claimant Count Change

13:30 USD Consumer Price Index

13:30 USD Core Retail Sales

15:30 USD Crude Oil Inventories

19:00 USD Interest Rate Desicion & Fed Statement

19:30 USD Fed press conference

Thursday 15th June:

09:30 GBP Retail Sales

12:00 GBP BoE Meeting Minutes

13:30 USD Philly fed

21:00 GBP BoE Carney Speaks

Friday 16th June:

07:30 JPY BoJ Press Conference

10:00 EUR Consumer Price Index

Monday 19th June:

– no big reports

Tuesday 20th June:

– no big reports

Remember, at the time of writing we’ve also got Theresa May rebuilding a governing party here in the UK. Watch out for volatility in GBP markets as things progress.

In the meantime, give your current trading tools a bit of consideration – are you definitely only using ones that serve you well? And if you fancy bringing more Samurai philosophy into your trading here’s that book I mentioned (free online version):

A book of five rings by Miyamoto Musashi

Happy Trading,

Rich