When you put a lot of work into your chart analysis you run the risk of ‘marrying’ your opinion.

It’s easy to become blinkered to any other possibility but the one you envisage.

You may analyse the markets yourself, or you might invest in the picture put forward by a market commentator.

And at a specific moment in time it might all make perfect sense. The logic is there and it shines dazzlingly bright.

But don’t discount how painful it can be to shred your hours of hard work, or write-off the money you invested in third-party analysis when the picture shifts.

The markets are organic beasts. And things change quickly.

So instead of shooting yourself in the foot, continuing to buy JPYUSD on every dip just because it seemed a great idea three weeks ago, despite the market having since developed into a raging downtrend, you need to take a more flexible stance.

(That JPYUSD situation is a purely theoretical example by the way, not a comment on the current market!)

The ideal middle-ground is not under prepared, not over prepared, but present in the moment and ready to react to whatever comes next.

Be coiled like a spring, with a feather-light touch

All this talk of China, Japan, and flexible stances… it’s making me think of martial arts.

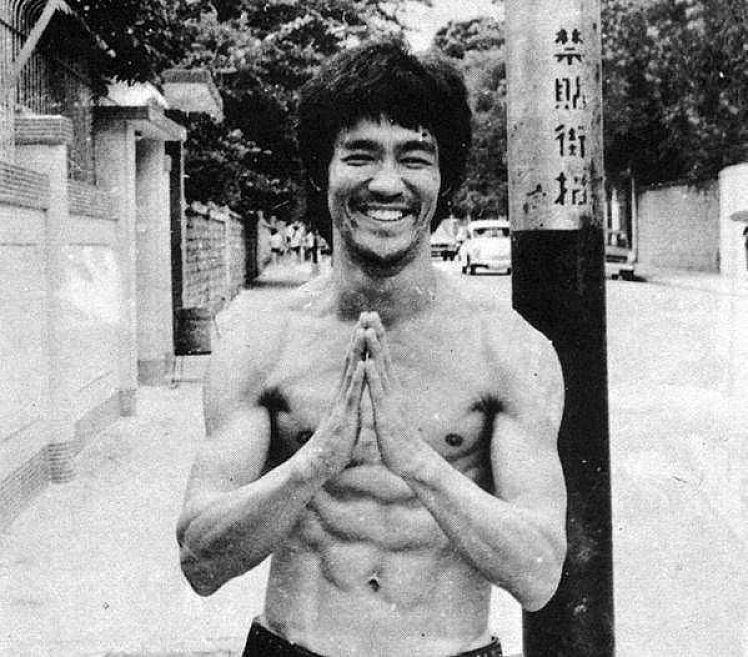

So check out this quote from Bruce Lee. It illustrates perfectly how to position yourself:

Empty your mind, be formless. Shapeless, like water. If you put water into a cup, it becomes the cup. You put water into a bottle and it becomes the bottle. You put it in a teapot, it becomes the teapot. Now, water can flow or it can crash. Be water, my friend.” – Bruce Lee

He talks about preparing to physically fight, but he could just as well be putting a comforting arm around the trader buying those USDJPY dips…

His sage advice steers the trader back on track: flow like water and don’t fight the market with a narrow opinion.

Anyway, it all ultimately leads back to the 3 truths of trading and the readiness to take responsibility for your own actions.

You might have heard me mention the 3 Truths before, but they really are the essential foundations for a healthy outlook on trading:

The 3 Simple Truths of Trading

- You don’t need to know what will happen next to make money.

- You will experience a random pattern of winning and losing trades

- Profit is made simply by gaining more money on your winning trades than you give back on losing trades.

At a high level, there is little more you need to know in order to trade well. Everything else that comes after – the buying and selling signals, the position sizing, the software and indicators – they are all just tactics that support these 3 rules.

So if you really want to find the ideal middle ground – the flexible stance – my advice is to take the 3 truths of trading on board.

I mean REALLY take them on board.

Forget how deceptively simple they appear. You’d be surprised how many losing trading campaigns can easily be avoided by honestly applying these 3 simple statements as a filter.

So make them your own. Ask yourself if you are operating outside the 3 Truths even as we speak.

And if you are, make the necessary changes immediately. It’s the sure way to put you on the road to consistent profits as soon as humanly possible.

Until next time…