PLUS: Discover What One of The World’s Most Successful Investors Thinks Will Happen Next

PLUS: Discover What One of The World’s Most Successful Investors Thinks Will Happen Next

I was at the Cheshire Country fair on Sunday and saw the most amazing example of someone keeping it together under stress.

Now, there was a time – a few years ago – when I spent a bit of time at these events. You know, hunting, fishing, birds of prey. All that kind of stuff.

I fancied myself as a bit of a country gent, got myself kitted out with all the shooting gear. But in the end, I just didn’t have the stomach when it came to pointing a gun at wildlife.

These days, I’d much rather wander round the fields for an hour and quietly appreciate it instead!

So anyway, at this fair they had something called Scurry racing, have you ever seen it?

It’s horses (small ones, ponies maybe?) racing around a compact course on a time trial. They pull two people – a driver and a kind of rear co-pilot – behind in a little carriage.

When team number three pranced out to compete, they looked immaculate. The horse was glowing with health and the lady drivers turned a few heads too.

They trotted up to the starting gate and that’s when things started to go wrong. The horse obviously didn’t like being held at a standstill, he was raring to go!

He snorted and bucked until he was flat-out kicking back at the carriage, hooves coming in at head-height for the driver…

The front of the carriage thrashed up and down off the ground every time he reared up. And the driver was leaning back as far as she could to avoid losing her teeth – there really were just inches in it.

When the horse finally settled, the driver jumped down and led it away by the reins. She gave a carefree wave to the open-mouthed crowd as she went.

And two things impressed me…

First, the fact she stayed on the carriage throughout. It would have been easy to jump off – but with devastating consequences. I’ll tell you about those in a minute.

Second, she was so young. Late teens, early twenties I’d guess. So talk about keeping your head under pressure…

If I ever put together a trading team I’m tracking this girl down for sure!

But the big lesson I saw was this:

When things go wrong – quickly assess the situation and concentrate on protecting the downside.

In sport, in the markets, in everyday life: you may think you have everything worked out nicely but unforeseen events can blindside you…

…unless you’ve trained yourself to expect the unexpected.

Then it just becomes business as usual.

This girl dealt with the horse situation so coolly she must have drilled it out many times in training.

The easiest thing in the world would have been to jump out of the way, because if one of those hooves made contact with her face, it would have been a broken nose, broken jaw, concussion… or worse.

But she knew if she bailed-out it spelt a worse disaster for sure. The horse would have gone on a free-for-all rampage with an empty carriage still attached. It could have injured itself horribly but the big risk was the safety of the onlookers…

Children, grandparents, adults with babes-in-arms, all stood a few feet away behind a flimsy little fence.

So it was a pretty selfless performance. She risked personal injury for sure, but by riding things out for a few minutes, she protected the downside – making sure no harm came to the spectators.

And she can be very proud the preparation work she’d put in paid off when the chips were down.

So have you ever faced unexpected situations with your trading?

Connection dropped to your broker just before a big number release – and you’ve still got orders working?

Market traded straight through your exit order with no notification of a fill from your broker?

Act of terrorism gaps the market over your stop-loss and you now need to manually extract yourself with the markets going crazy?

I’ve had all kinds of strange stuff to deal with over the years and it’s absolutely nothing to fear. Just be smart and have contingency plans in place ready for when you need them.

Here are three ideas you can put in place today to help prepare for the unforeseen and protect your downside:

1) Make sure you’ve got a direct phone number for your broker. And check it works. Test you can get straight through. If you lose online connection or there are technical problems with your trading platform, you need the ability to manage your orders quickly.

2) Make sure your spouse, partner, or trusted other knows how to get you flat and cancel your orders.

If you’re unavoidably detained and can’t speak to your broker yourself, make sure someone can do it for you.

For example: if you – heaven forbid – break your leg while you’re out and about and you’re holding a forex position, have someone you trust know exactly what to do and who to phone.

3) If you’re caught the wrong side of a panic-move you can usually get out at a better price.

Hold your nerve and wait until the first knee-jerk reaction to the event starts to run out of steam. Wait until the initial panic buying or selling pressure subsides, and you’ll usually be able to get out at a better price as the market retraces.

Recommended Reading:

Recommended Reading:

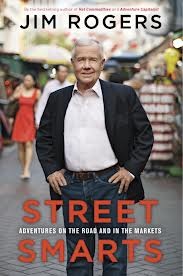

Jim Rogers – one of the most successful investors ever – spills the beans on his global outlook for the coming years. It’s not a short-term trading book, but he’s got a habit of calling the big trends right on the nose.

Listen to what he says and you’ll get an idea of how he sees the money-flow playing out between nations over the next decade.

Not only that, you’ll see how he’s positioned his own family to prepare for the coming changes, why he says the age of Wall Street is over, and how he sees tomorrow’s economy being driven by those who manufacture and produce things.

Fascinating insights and there are some great stories in there too. Did you know he’d coxed the Oxford crew to victory in the Oxford V Cambridge Boat Race?

Have a look inside (courtesy of Amazon) here

Be Prepared: Market Moving Data Coming This Week (London Time – BST)

Watch out for liquidity being re-introduced by UK players after the extended Bank Holiday weekend (positions will have been scaled back before the close on Friday).

There’s not a great deal happening on paper this week. All the analyst talk is about the Fed’s ‘Tapering’ plans. I say follow what the charts are telling you and let the fundamental analysts keep guessing at reasons behind the moves!

Tuesday 27th August:

15:00 US CB Consumer Confidence (USD)

Hope you enjoyed this issue. Have you ever thought about contingency plans before? Do you have any of your own already in place?

PLUS: Discover What One of The World’s Most Successful Investors Thinks Will Happen Next

PLUS: Discover What One of The World’s Most Successful Investors Thinks Will Happen Next Recommended Reading:

Recommended Reading: