When markets cease to function properly, like they do from time to time…

(I’m taking SHOCK events that send things spinning out of control)

…most players make a run for the exits.

They get the hell out and watch from the sidelines until the dust settles.

And this has a big effect. The buying and selling forces that normally push and pull against each other, keeping the market vaguely in check, disappear.

It means markets that normally bob up and down at a relatively sedate pace turn into raging monsters.

First: The shock

Let’s say something big hits the news wires: a shock interest rate decision or something.

A seller might want to dump his position instantly, at the current market price, but in fast moving markets the nearest buyer might only be willing to buy several points lower.

Any buyers might not see any value in buying until the market drops down to their price, so that’s where the transaction takes place: at the nearest price being bid.

It’s something that can easily frustrate traders…

‘Arrrrgh! I hit sell when the market was at 80! So why did I get this horrible fill 7 points lower at 73?’

Even spread bet firms are affected by the withdrawal of liquidity (that’s what it’s called when market players bold for the door: a withdrawal of liquidity). They can only offer prices and conditions which reflect the underlying market.

When slippage becomes a terror

So when you get ‘slippage’ of, say, 7 points on your fill price (slippage is the difference between the price you were expecting and the fill price you received) it’s only a reflection of real-world conditions.

It shouldn’t come as too much of a surprise, especially when you’re already watching the market leap around like a wild animal.

But to see what’s really going on, let’s look at this through the lens of an example…

Let’s say a trader – Joe Bloggs – had a short term bullish outlook so he was long the market. He was looking to make money from an up-move.

Now when the markets started to tank he might have wanted to get rid of that position as soon as possible. That sounds pretty reasonable doesn’t it?

But I’m going to show you how massive slippage can occur in conditions like this, and how that can have a devastating effect on his trading account.

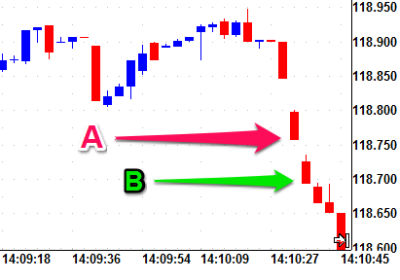

We’ll make a start looking at a regular candlestick chart, but it’s a very short term one. Each of the candlesticks here shows just 3 seconds of trading activity. Remember that, it’s important!

Here we go…

So let’s say that despite being aware of very thin (low liquidity) conditions, Joe insisted on continuing to trade.

He finally pulled the plug on his long trade at point A. He’d had enough and wanted out. But by the time he’d pressed the button, and his order had been routed through to his broker, the market was already trading at point B – that’s just 3 seconds later.

It’s a difference of 5 pips.

So it’s not difficult to see how big slippage can occur in low liquidity conditions.

Now, 5 pips slippage is bad enough, but take a look at what happens just minutes later…

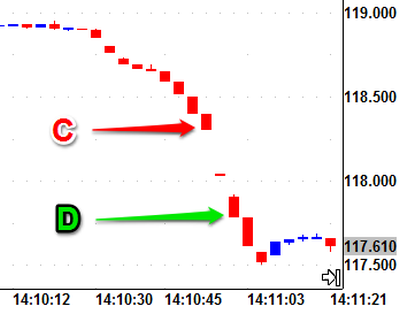

The distance between point C and point D is 52 pips!

And do you know how long it took the market to travel that far? Just 6 seconds.

You can see huge gaps between the candlesticks where no buying interest came in at all. The market was swamped with sell orders and the buyers were nowhere to be seen. That’s what drove price down so aggressively.

Is it possible to still trade profitably in these markets?

Yes, it is still possible to make profitable short term trades in volatile markets, but there is a caveat:

There are times when you should simply sit on the sidelines until you see a level of normality return.

Keep an eye on the way the last price changes as the trades go through. If the market is jumping 5, 6, 10 pips each time it means there is no liquidity present.

So it’s one thing to pore over charts at the end of the day and fantasise about riding rapid plunges to the downside, but, let me assure you, it’s no place to be risking your trading bank.

The huge difference between anticipated fill prices and actual fill prices – once slippage has made its mark – is simply not worth the risk.

There will always be other opportunities. And I think it’s better to watch low liquidity carnage play out without getting involved.

Jealously guard and protect your trading bank in times like this. You have the luxury of choosing when to do battle in the markets.

Just because the markets are open doesn’t mean you always have to trade!