PLUS: Check out these medium-term target levels in EURUSD

PLUS: Check out these medium-term target levels in EURUSD

Teeth clench, temples throb, stomach churns, you can’t think straight…

Ever feel like this when you’re trading – maybe when a trade’s going against you, getting near your stop loss?

… fingers drum the desk, leg twitches up and down, hand reaches for the keyboard – to kill the trade that torments you.

And CLICK… you’re out.

At least you can think clearly now, but that was a break of your system’s rules. And now you’ve got that whole ‘trader’s remorse’ thing to go through… kicking yourself for not keeping your cool.

Does it sound familiar?

I used to go through something like it on a regular basis, two or three times a week. It usually rears its head a few months into a trader’s career – once he’s got a bit of in-the-trenches experience behind him. He’s already felt the sting of the market and now it’s a case of once bitten, twice shy.

And it can be the start of a nasty consistency problem – the number one gripe of independent traders.

But you know, there really is no shortage of trading systems offering a positive edge. Sticking with them through the odd rocky patch – to actually get those positive results – can sometimes be the challenge if you don’t have the right tools to help you.

Why is it some traders sail their way through sticky patches yet other traders sink?

They trust their system, stick to it, and enjoy their just rewards whilst others go to pieces after just a couple of losing trades. Even though they KNOW they should expect some losses.

I know the sinking feeling well. I’ve had my share of sleepless nights reliving what I should have done, if only the clock could be wound back.

And you know what? It’s ok to make these mistakes. I think it’s something you have to go through while you learn how to handle it … a trader’s rite of passage. Unless you’re some kind of emotionless ice-man – chances are you were born with the same instincts for self-preservation as the rest of us. You just need to learn how to over-ride the panic signals your brain sends when it senses your money is at risk.

So today I’m going to give you a very valuable technique:

It really could be the make-or-break factor that decides whether your system works for you. It’s something I was taught that really is a secret weapon for consistent performance.

First, I’d like you to imagine a child’s Etch-a-Sketch toy – the screen covered with whirls and swirls of black scribble. This represents the agitated state of mind you can get yourself into by worrying and fretting about a trade.

Next, imagine sweeping the little handle across the toy that erases all the scribble, giving you a nice clean slate. This is the return to a calm, efficient mind – the kind that lets you operate your trades without emotion.

It’s going to be as easy as that.

Shifting from agitated overwhelm to a clear mind is going to happen VERY quickly with this… I’m going to tell you about a special way to adjust your breathing that can give you almost INSTANT self control and mental clarity.

If you ever feel yourself starting to flap because you can’t bring yourself to pull the trigger, or because a trade is going against you – even though you’re trying to follow your systems rules perfectly – this is what you should do immediately. It’s called Alternate Nostril Breathing.

This is the kind of thing Tibetan Monks practice up in their Himalayan temples

It’s real ‘mind-over-matter’ stuff. I don’t think you need to worry about levitating out of your chair or anything like that but there have been scientific experiments where people have consciously slowed their heart rate down to almost nothing, and even controlled their body temperature – surviving ice baths for hours at a time – by using breathing techniques to command their mental processes and metabolism.

Getting you back in the right frame of mind for trading should be a walk in the park!

Here’s how to do it:

1. As soon as you start to feel a loss of discipline approaching, turn your chair around to face away from the screen or get up and walk outside.

2. Close your eyes and tilt your head down a bit so you lengthen your neck at the back and rest your thumb and forefinger either side of your nose

3. Gently press your left nostril closed with your finger, focus your mind on counting as you breathe out through your right nostril to a count of four

4. Deep inhale through the right nostril to a count of four

5. Close the right nostril and deep exhale through the left to a count of four

6. Deep inhale through the left to a count of four

7. Close the left nostril and deep exhale through the right to a count of four. This completes one full cycle

8. Continue for ten cycles – or more as you get comfortable with it. You can also try and extend your exhale to be longer than your inhale for an increased effect.

The theory is – by doing this – you’re balancing out the right and left sides of your brain and tuning into a special relaxed frequency of brainwave activity. You might feel a little bit spaced-out when you first open your eyes (feels good!) and you can use it to de-frazzle yourself in any situation…

Don’t like flying? High-pressure putt on the eighteenth hole? Kids testing your patience?

It’ll leave you in a mentally alert but chilled-out state. Give it a try now – don’t wait until the day you need it!

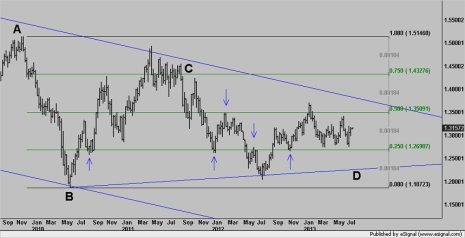

EURUSD – Longer Term Outlook

I was doing a bit of analysis on EURUSD at the weekend – looking for some longer term targets.

Thought you might like to see what I’m looking at:

EURUSD – Weekly

So here we are on a weekly chart, I’ll scale out like this occasionally to try and find some areas of support and resistance to aim for in the weeks and months to come.

A to B – That’s the current dominant leg of the market’s price action. See how everything coming later is contained within the range of that move? I’ve dropped the 25%, 50% & 75% retracement levels onto the chart. You can see how the market has already respected the 25% level with tests from above and below (marked with the blue arrows). The 50% level has also held – once with a touch & reversal (blue arrow) and once with a deeper penetration.

We’re stuck in a range between the 25% and the 50% levels at the moment but I’m pretty happy with the way those levels are working so I’ll be looking for a test of the 75% level if the market breaks out to the upside…

C – It’s got to get through the upper channel line first, but my upside target is 1.4325. The 75% retracement level also ties in very nicely with that congestion area from mid-2011 which adds a bit more weight to this level.

D – To the downside, I’m looking at a stretch to the upward sloping trend-line labelled D. It’ll be the third touch of that line so there’s a good chance of a bounce to some degree.

Might take a while to reach either of those levels but they are my medium term targets.

Be Prepared: Market Moving Data Coming This Week (London Time – BST)

Pretty quiet on the reports front this week. Second quarter GDP for the UK will be worth watching on Thursday – the market is looking for a decent lift from the 0.3% delivered in 1Q.

Wednesday 24th July:

15:00 US New Home Sales (USD)

Thursday 25th July:

09:30 UK GDP (GBP)

13:30 US Initial Jobless Claims (USD)

15:00 US Durable Goods (USD)

I hope you enjoyed this week’s issue. Let me know what you think of those EURUSD targets and until next time…

Happy Trading

PLUS: Check out these medium-term target levels in EURUSD

PLUS: Check out these medium-term target levels in EURUSD

Clever little exercise, just tried it and you know what it does make things a bit hazy. Will try it out next time my leg starts twitching. No good if you suffer from a blocked nose though!