Secrets of The Hungarian Dancer Who Made $2.2 Million in Trading Profits Part-time… While Touring The World With His Dance Troupe

Secrets of The Hungarian Dancer Who Made $2.2 Million in Trading Profits Part-time… While Touring The World With His Dance Troupe

Forget Strictly Come Dancing…

Here’s a performer traders can really take a lesson from.

Back in 1952, in a Canadian nightclub, a Hungarian dancer was offered a wedge of fifty-cent shares in an obscure company as payment…

Two months later, the same shares were trading at a dollar and ninety-two cents. They showed a profit of $8,500.00.

Nicholas Darvas was hooked on trading right there and then.

And he didn’t do too badly for himself either. Within seven years he’d racked up profits of over $2.2 million. And the amazing thing is he did it all part-time… while touring the world with his dance troupe.

He didn’t have the luxury of real-time quotes or charting software either. He made all his trading decisions by skimming over share prices in the copies of Barron’s (financial publication) his broker airmailed out to him. Darvas simply phoned any instructions back to his broker.

But it wasn’t all plain sailing…

After those early windfall profits, he set to work developing his first ‘fool-proof system’. Needless to say, he promptly whittled his account down by five grand within twelve months!

It was the usual story… overtrading, taking profits too early, refusing to take losses when reality was staring him in the face…

You probably know the kind of hurdles he had to get over. It seems to be a common stage traders go through before finally things drop into place and the markets let you properly wet your beak.

So anyway, back to the drawing board he went…

He had a few more ups and downs but then he struck serious gold.

His Methods Start To Work

Some say he was just lucky. That the bull market he jumped into couldn’t fail to make anyone rich…

But the difference is he actually did it… where thousands of others stood aside and watched.

So what was his secret? And more importantly… can we apply it to the Forex markets?

Well the nice thing about share trading strategies is that many of them can indeed be adapted to the four or eight hour forex charts. We get to trade a kind of cranked-up version of them.

(And I’m convinced many of these famous trading names from the past would have given their right-arm for access to the technically-traded currency markets we now enjoy. They probably wouldn’t have given shares a second glance.)

How to Trade Forex With The Tailored Darvas Box Method

As he studied his books and charts, Darvas realised price movement had a kind of pattern to it. He noticed when markets went into a defined up or down trend, it tended to last for some time…

And within those trends, the price seemed to move in steps, or “boxes” as Darvas describes them.

He bought his shares when prices broke out of the top of the box, when momentum and market sentiment were strong.

And that’s the general concept we can steal and customise to find some high probability forex trade entries. We’re not trying to ride the full long-term trend like Darvas did. We’re looking for more of a tailored-fit hit-and-run result.

These trades are also a bit different to typical breakout entries because we wait for that little area of congestion to print once the breakout has occurred…

But that’s the clever thing about it. It’s kind of a double-check safety mechanism that can filter away false breakouts.

Here’s what you can look for in the case of a Long Trade (just do the opposite for Shorts):

- Wait for the market to take out a prominent high and then look for it to pull back near to the price level of the prominent high.

- Draw in a horizontal line at the breakout extreme – this is the top of the box. Draw in a horizontal line at the low of the pull back – this is the bottom of the box.

- Go long on a break through the top of the box.

You’ll need to find a suitable technical level for your profit target (or you can simply trail your stop loss upwards as the trade develops).

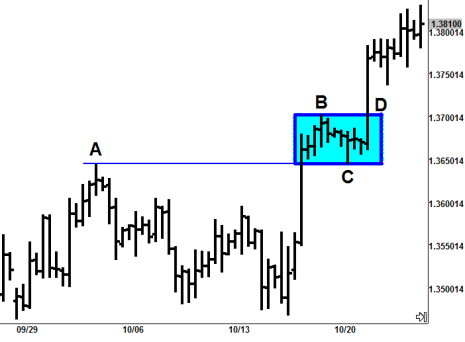

Here’s a nice recent example from EURUSD:

Tailored Darvas Box is highlighted blue.

A: This is the kind of prominent high we can use as a trigger. It must be an obvious high-point to the market in general. In this case the high is 1.3646 from 03/10/13.

B: This is the extreme of the breakout beyond point A. We’re still only watching the price action at this stage remember. We need to see a pullback near to 1.3646 yet.

C: Here’s the pullback. We can now draw those lines in at B (for the top of the box) and C (for the bottom of the box). We place a Buy Stop order to go long on a break through the lid of our box.

D: Here’s the entry point. We go long at D as the market moves higher.

That’s only half the story of course. You still need to manage your exposure and you need to find a sensible level to take your profits.

There were 120 pips available on this trade inside two days and at least 100 pips were easily captured with a simple trade management system I run with this strategy. The initial risk would have been around 28 pips.

Out of respect to my students, I can’t give the whole shooting match away here but if you’d be interested in seeing the full Tailored Darvas Box strategy – drop me a quick email.

And if you’d be interested to read more about Nicholas Darvas and his methods, check out the following two books he wrote:

How I Made $2,000,000 in the Stock Market

Wall Street: The Other Las Vegas

STOP PRESS! Promising New Trading System

I’d been looking forward to testing this for weeks…

It’s been billed as one of the most successful Forex Strategies of all time.

They claim it averages £1,772.00 per month – tax-free…

And wouldn’t you just know it… as soon as I get my hands on it, they’re about to change it all – dramatically.

I’m making a video all about it for you. It’s one you really should see, but you’ll definitely need to watch it before the weekend.

I’ll be emailing you with the video link as soon as it goes live.

Be Prepared: Market Moving Data Coming This Week (London Time – BST)

Wednesday 20th November

00:00 US Bernanke Speaks USD

09:30 UK MPC Minutes GBP

13:30 US CPI USD

13:30 US Retail Sales USD

15:00 US Existing Home Sales USD

15:00 US FOMC Dudley Speaks USD

19:00 US FOMC Meeting Minutes USD

Thursday 21st November

08:30 DE German Manufacturing EUR

10:05 EUR Draghi Speaks EUR

11:00 UK Industrial Trends GBP

13:30 US Jobless Claims USD

13:30 US PPI USD

15:00 US Philly Fed USD

Friday 22nd November

07:00 DE German GDP EUR

09:00 DE German Business Climate EUR

Let me know what you think of the Darvas Box technique. Just hit reply to this email and tell me your thoughts.

Secrets of The Hungarian Dancer Who Made $2.2 Million in Trading Profits Part-time… While Touring The World With His Dance Troupe

Secrets of The Hungarian Dancer Who Made $2.2 Million in Trading Profits Part-time… While Touring The World With His Dance Troupe