Use this simple results tracking method to keep you focused on long-term trading success

Use this simple results tracking method to keep you focused on long-term trading success

PLUS: read this book if you trade economic news announcements

It’s not much fun when you’ve got a proven, profitable trading system but you’re putting yourself through the wringer trying to stick to the rules.

So I’ve got a simple technique here today that may help you.

It’s a special way of arranging your results so you don’t get sidetracked by the ‘noise’ of individual trade outcomes.

And it doesn’t matter what system or strategy you’re trading. You can apply this to anything.

You see, it’s just a subtle shift in perspective really… a little bit of psychology in action.

But take on board what I’ll show you, and here are three solid benefits you can take away with you right away:

- You can prevent yourself ducking out of taking good trades

- It can help stop you tinkering around with your system, trying to make it ‘perfect’

- And you can force yourself to focus on long-term profitability (where the big money lies) instead of agonizing over the daily ups-and-downs in your trading account.

Now, from personal experience, I’ve found the best way to avoid getting bogged-down and demoralised by inevitable losing trades is to do everything within your power to remove their hold over you.

…even if it means a little bit of self-trickery!

And I’ve seen how many other Forex traders live trade-to-trade… their confidence levels lurching up and down. It’s no way to find trading consistency.

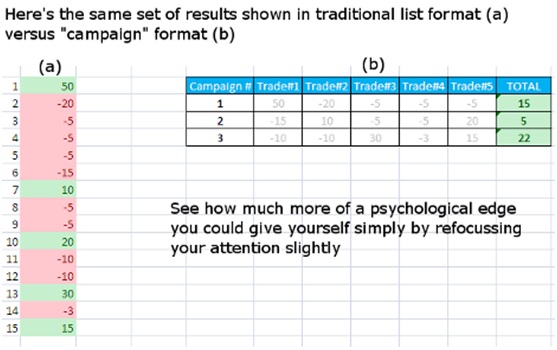

So the tactic I’ve got here for you clusters your trade results together in little batches. Each individual win or loss now becomes a cog in the machine of a broader trading campaign.

It can take the sting right out of a losing trade because you’ll already be looking straight ahead to the next trade in the batch.

And it’s really simple to set-up…

It’s going to take you about ten minutes to work out the best batch-size for you to use from examining the recent results your system generated.

And it’ll take about another five minutes to set the spreadsheet up…

But once you’ve done it, you’ll have given yourself an instant psychological edge over how you were relating to your results beforehand.

So here’s the step-by-step guide to reframing your trading results in a powerful, confidence-boosting format. It’ll help you avoid uncertainty, control negative emotions and keep you focused on long-term success:

- Get your recent trade results in front of you either on paper or on your computer screen (if you’re using a rule-based system, make sure you refer to the complete trail of system results rather than just the trades you chose to participate in)

- Have a quick tot-up to see which batch-quantity size of trade results usually gives you a positive sum. If you add together strings of 10 consecutive trade results do you usually get a positive overall total? How about 8 consecutive trades, or 7?

- Settle on the smallest batch quantity that gives you consistent positive results (ideally around 80% positive). Remember, this isn’t a precise science.

- Start tracking your results in a campaign-format like example B in the screenshot below – it’s a simple shift in perspective but incredibly powerful. You can also change the font colour of the individual results to light grey to take the emphasis right off their relevance. You could even keep those columns hidden in your spreadsheet until you need to type in a new result.

This is an easy way to notch your mental-game up to the next level.

But if you already have total control over your trading emotions…

If you never second-guess the signals your trading system gives you and if you never take trades outside your system’s rules then don’t worry – you probably don’t need to do this.

Don’t risk upsetting a routine that’s already working well for you.

Otherwise, just look over your recent trades, quickly work out the best batch size for you and start recording your results in that “campaign’ format.

It can be a massive psychological boost to see that wall of positive green numbers on your screen.

But please remember this method can only optimise the results of a trading system with an existing positive edge.

(If you’re not sure how effective your own trading system is, or if you’re looking for new trading ideas, keep an eye out for the updates on my new strategy – coming very soon.)

High Probability Trading – Marcel Link

Recommended Reading:

This is a slightly more advanced book of technical trading techniques.

If you’ve gone through the stuff in Alexander Elder’s books – Trading for a Living, and Come Into My Trading Room – this might be your next port of call.

The author – Marcel Link – ran a futures brokerage for years so there’s some nice behind-the-scenes observations here.

He shares the mistakes he saw his own trading clients make time-after-time. And this can be a kind of accelerated-learning pathway for you. You can learn at their expense!

There’s a whole range of technical methods you can examine here. But if you’d like my recommendation for a ‘quick hit’ of usable knowledge from this book, I’d concentrate on two sections:

1) How to trade the news (p60 to p73): There’s a lot of sensible stuff condensed into 13 pages. Trading the economic news releases that move the forex markets isn’t for everyone, but if you do have an appetitite for more aggressive trades you can get a good grounding here.

2) Trading off multiple time-frames (p78 to 95): Trading without seeing the ‘bigger picture’ is a common mistake. It’s easy to become blinkered and just follow – for example – the sixty minute chart. You’ll see here how to gain a better perspective of the overall market and time your trades more effectively by also monitoring the action higher up the timescale.

You can find it on Amazon here

Be Prepared: Market Moving Data Coming This Week (London Time – BST)

The US Dollar is still having a bit of a rough ride. Talk is of continued weakness into the Fed’s interest rate decision on Wednesday (with Bernanke to speak shortly after).

Cable (British Pound) has been particularly strong against the dollar over the last month and reached an eight-month high last week. If you’re a Cable-trader, keep an eye on Wednesday morning’s MPC minutes.

Wednesday 18th September:

09:30 UK MPC Meeting Minutes (GBP)

13:30 US Housing starts (USD)

19:00 US FOMC Statement (USD)

19:00 US Interest Rate Decision (USD)

19:30 US Bernanke speaks (USD)

Thursday 19th September:

09:30 UK Retail Sales (GBP)

13:30 US Initial Jobless Claims (USD)

15:00 US Existing Home Sales (USD)

Friday 20th September:

13:30 CAD CPI (CAD)

17:55 US FOMC Bullard speaks (USD)

Let me know if you end up using the campaign-format spreadsheet. It created a real mental breakthrough for me when I discovered it, so I do hope you find it useful.

Use this simple results tracking method to keep you focused on long-term trading success

Use this simple results tracking method to keep you focused on long-term trading success