PLUS: How to Find Simple Forex Trades With 80% Reliability!

PLUS: How to Find Simple Forex Trades With 80% Reliability!

We were round at the neighbour’s for a barbeque on Saturday and I was telling John, our host, this old trading tale…

He went a bit quiet, turned a sausage with his tongs and said “that’s just weird… it makes me think of zombies or something”.

But it’s not as strange as it sounds.

I’ll tell you how it all works and also where to find similar trades in Forex.

First, let me tell you the story…

In the early 1900’s a wealthy grain trader lay on his death bed. He’d lost his wife many decades earlier and so had dedicated himself to his three children.

The children led lives of privilege…

They’d been sent to the best schools and never wanted for a thing. But now they were older, they mostly just burned through their trust fund income as fast as they could, having a bit of a party.

The trader thought them lazy.

He regretted spoiling them and could see how they were just itching to get their hands on the rest of his loot.

But the trader was a wise man, he’d figured out how to teach them the lesson that would stand them in good stead once he’d gone:

As darkness drew in around the trader, the children gathered at his bedside.”Go and see Jim Levit” the trader croaked. “I’ve left instructions with him. You’ll never have to work a day of your lives”.

So the trader passed away and as soon as they could, the children raced around to see Jim Levit – attorney at law.

Jim slipped a small piece of paper out of a file onto his desk and read aloud what was written on it:

“To my three children, I leave my most valuable possessions…”

Smiles and knowing glances were exchanged.

“…Sell March Wheat on January 10th, Buy May Wheat on February 22nd, Sell July Wheat on May 10th, Buy December Wheat on July 1st, Sell December Wheat on September 10th and Buy March Wheat on November 28th.

If you follow these instructions every year, the wealth you were expecting will surely be yours. The rest of my estate I leave to charity.”

His most valuable possessions were dates for buying and selling Wheat futures contracts!

I’d love to have been a fly on the wall in that room. I’ll bet you could have heard a pin drop.

So anyway, legend has it all three of the trader’s children went on to place the trades year-after-year and sure enough, became very wealthy in their own right.

Once they were ready to retire, the three of them agreed to share their secrets with a few of their close associates and the story spread.

The buying and selling dates became pretty well known, they’re called the “Voice from the Tomb” trades because they continued to work just as the old trader said they would.

No one outside their little circle knows for sure exactly how the trades are managed once the positions are open. But rumour has it their special method still works, even today.

A trader called George Kleinman – now president of Commodity Research Corp. – did a bit of testing. Over a thirty five year period, if he’d bought or sold on the ‘Voice from the Tomb’ dates and simply looked for a $750 profit per contract against a $750 stop loss, he found profitable trades 75% of the time. Not bad!

75% Profitable – but what’s the logic behind the method?

Do you think it all sounds a bit haphazard?

Well, it’s nothing mysterious. The trades are simply being fuelled along by seasonal trends.

You see, in many markets there are conditions and events which happen every year and influence price to a greater or lesser degree.

The change of the seasons and the harvest-cycle are the main influences in the grains. But what about the currencies… can you gain an edge from seasonal tendencies for your Forex trades?

There are no guarantees of course, but if you found a seasonal pattern that repeated with 80% reliability within the last 15 years – you’ve got yourself a statistically significant edge.

You don’t really need to know the reason why the pattern is there. It could be down to large corporations repatriating funds at certain times of the year to make their books stack-up. It could be due to something like the seasonal influence of oil prices affecting a country’s currency (the Canadian Dollar tends to be sensitive to the price of oil).

Whatever the reason – if you’re aware of the pattern, you can use it to your advantage and make it part of your decision making process.

But who’s got time to go trawling back through fifteen years worth of data looking for correlating patterns?

Worry not my friend. The good people over at Moore Research do it all for you!

They crunch the numbers going back 15 years, looking for trends with a minimum reliability of 80%. They do a bit more proprietary ‘fine-tuning’ and then deliver a complete trading strategy outline to their traders.

They’ll even give you the optimised entry and exit dates for the trade, the average profit earned, and also the date with the optimum accrued profit.

Their Forex research can easily be applied to the spot currency markets and if you’re interested, they offer a free 14 day trial. You can read about it here.

Quick Charting Tip: MRCI Seasonal Trade Chart

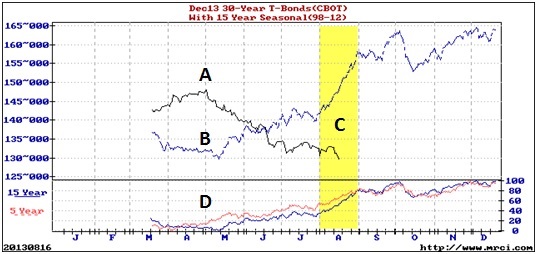

Since we’re talking about the seasonals, I thought I’d show you an example of the kind of research you can find over at MRCI and how to use it for your own trading.

Out of respect for their copyright material, I’m showing you the free sample chart they display on their homepage. It’s a T-Bond futures chart but the principle is exactly the same for the Forex stuff you’ll find in their subscribers area.

A – The black line is the current price action

B – The blue line is the seasonal pattern

C – The yellow area is the statistically significant window of opportunity.

D – The chart in the lower pane is simply the 15 year seasonal pattern with the 5 year seasonal pattern overlaid. You can check the more recent years are not beginning to stray from the 15-year pattern.

On this chart, the window of opportunity is to buy on 01/08 and sell on 31/8. But rather than go in blind on the entry date, I look for a breakout pattern to actually enter the trade. I like to make sure there really is buying pressure in the market first, and then let the seasonality simply carry the trade along once the trade is triggered.

So for example, you could look for a simple breakout of the 21-day highs anywhere within the yellow zone to get you in, and then exit with a market order on the specified exit date. Adding the extra trade entry filter can keep you out of some of the trades that aren’t really coming off this year for whatever reason.

Trading the seasonals can be a really nice way to trade. You get your ‘playbook’ out at the start of the month, have a flip through the seasonal charts to see which opportunities are due to come in, and simply wait for your entry signal in whichever currencies you’re keeping an eye on.

Moore Research do all the heavy lifting for you!

Be Prepared: Market Moving Data Coming This Week (London Time – BST)

I think I might have cursed us last week by wishing for things to ‘liven up’. Did anyone get caught out by that whiplash volatility in EUR/USD last Thursday?

Wednesday 21st August:

15:00 US Existing Home Sales (USD)

19:00 US FOMC Meeting Minutes

Thursday 22nd August:

13:30 US Initial Jobless Claims (USD)

19:00 US FOMC Fisher Speaks (USD)

20:15 US Treasury Sec. Lew Speaks (USD)

Friday 23rd August:

07:00 DE German GDP (EUR)

09:30 UK British GDP (GBP)

13:30 CAD Canadian CPI (CAD)

15:00 US New Home Sales (USD)

Hope you enjoyed this issue. Let me know what you think of the seasonality idea – is it something you’ve seen before?

PLUS: How to Find Simple Forex Trades With 80% Reliability!

PLUS: How to Find Simple Forex Trades With 80% Reliability!