Back in October I was playing around on a popular charting platform.

The software itself is nothing unusual. Anyone can get their hands on it immediately on the internet.

In fact, it’s probably the kind of thing you’re using right now to follow the markets.

But something I stumbled upon stopped me dead…

I found a hidden tool.

It’s something most traders completely ignore if they know it is there at all. Even I didn’t realise it was widely accessible in such a powerful format.

(I first used this tool to trade the US Bond Futures back in 2005 – it’s what the professionals use to gain a massive edge – and back then I paid $247 a month for the service.)

Yet here it now sits, hidden in plain sight and available to all.

And most importantly…

It now gives direct insight into institutional order flow for the Forex markets.

I’ve never been able to find any service that analyses the currency markets accurately in this way and I’ll explain why to each of the beta testers who come on board.

But this is HUGE.

It’s what’s going to let you see with precision the price levels relevant to any market…

…where they are likely to move to next, where they are likely to stall or reverse, where to set your trap for accurate trade entries, and where to safely exit.

It’s like having a hidden map, or trading ‘Sat-Nav,’ at your fingertips.

So to say I’m excited about the potential of my new strategy using this tool is an understatement!

Now, I can’t give too many details at this stage. All I can say is this method throws out winning trades with incredible reliability. In fact, these trades are so reliable, once you set them up you don’t even need to follow them on charts, because…

You’ll already KNOW where the market is trying to reach and where it is likely to turn next.

So let me ask…

Have you ever noticed professional traders don’t seem to bother watching charts so much?

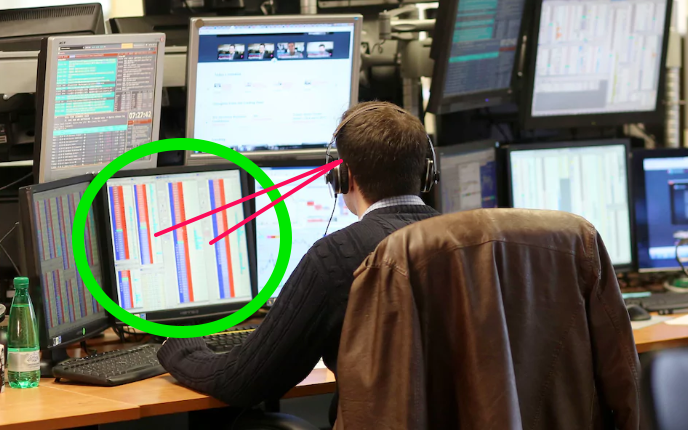

Take a closer look nest time you see a trading room on the TV news. The traders might have charts open off to the side of their monitor stack, but their MAIN focus will be on something else. Something clean, simple, and uncluttered…

This trader watches his price ladders and uses simple 4th Dimension analysis for his trades

It’s because they use this ‘4th dimension’ analysis I’ve been telling you about to track order flow and construct their high-probability trades. And I can’t wait to share their sneaky secrets with you!

With this strategy you don’t follow any chart indicators or look for complicated patterns…

You actually tap-in to the core underlying structure of any market.

The markets simply cannot move without leaving behind a clear and obvious ‘digital footprint’ that we use to build our high-probability trades.

Once you see it working it seems almost like magic.

But let me give you an idea of the potential of my new ‘profit ladder’ strategy…

I’ve whittled down a main portfolio of markets to 4 heavily traded Forex pairs. These are the ones we’ll watch on a daily basis. We might add more once the British Pound has settled down after Brexit, and using the same principles we can jump on board any significant market move on an ad-hoc basis.

This means if the US stock markets crash we can use the same techniques to profit…

If Bitcoin wakes-up and rallies again, we can hop on and ride the up-move…

You get the idea.

But on a DAILY basis we’ll be looking at between 3-6 potential trades in each of the 4 main markets.

They won’t all trigger. Some days we might have 8 trades some days we might only have 1.

They’re quick trades. I’d expect us to be in and out within a matter of hours. I suggest the risk on each trade is kept to a conservative 1-2% of your overall trading bank.

And the beauty of this is you can do it all at arm’s length. There’s no need to be glued to the monitor once I’ve sent the trading data through to you each day.

In terms of potential returns…

In a typical month I suggest we target a 10%-20% return on account.

Some months might be more, some months might be less.

But with compounding applied that’s a potential 643% return within 12 months

By simply setting the trades up each day and letting them do their thing.

So if you’ve ever wished for a consistent, simple, low-risk strategy that can deliver meaningful returns each month, I think you’ll like it.

But, of course, saying it is one thing. Actually seeing it happen with your own eyes is another!

That’s why I’m writing to you today. I really want to put the strategy through its paces and make sure the early results can be replicated.

So I have a handful of extra tester places up for grabs.

If you are interested in trying this with my full support you need to email me at [email protected] no later than Saturday 19th January and just put ‘Ladder Tester’ in the subject line.

Please include details of why you think you should be a tester. I’m looking for people that trade around a day job or other daytime commitments as well as a few that can monitor the markets live.

It would also be helpful if you give me an idea of your trading experience.

(You don’t NEED loads of previous experience, by the way. I just want to get a good mix of experience levels for the test.)

If you are one of the lucky ones I’ll be in touch with further instructions. I’ll be giving you free training in the strategy PLUS ‘done-for-you’ trading data for the duration of the test.

I’ll notify the winners by Monday 21st January.

If you don’t hear then please take it you were unsuccessful on this occasion.

I’ve set up a special email address for you to reply to: [email protected].

Please make sure you send your message to the correct address. Don’t hit ‘reply’ here or send it to my usual address or it’ll end up getting overlooked.

Good luck!