Imagine that you’re trading with a 3:1 risk-reward profile. You have a fund of £10k, and you’ll risk 2% on a trade. So, you’re risking £200 on a trade, to make £600.

Imagine that you’re trading with a 3:1 risk-reward profile. You have a fund of £10k, and you’ll risk 2% on a trade. So, you’re risking £200 on a trade, to make £600.

Things are going well, and you’re currently £400 in profit.

That means that you’ve got £600 hanging in the balance (The £400 profit plus the £200 to your stop loss) – which is 6% of your total trading fund.

By aiming for high rewards like this, you’re skewing your risk profile way off balance.

Fortunately, there’s a way to rebalance your trade. So – provided you take advantage of the tools available on your spread-bet platform – you can protect those gains – while still getting a chance to run at an open goal!

Using trailing stops

More and more spread-bet firms are now including trailing stops on their charting package, which means that you can simply leave your profits to run, while protecting your winnings at the same time.

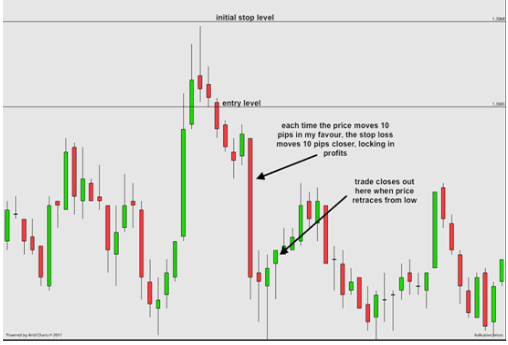

Here’s an example of a short trade, with a trailing stop set to follow the price in 10-pip increments.

Of course, moving your stop loss about is not without its dangers. Especially when you’ve carefully chosen your stop level according to key levels of support or resistance.

It’s always a good idea to put a little thought into where you place a stop loss, so that it doesn’t fall on just the wrong side of a key level, where it will be especially vulnerable to getting touched out.

Very, very often, you’ll have a great set-up, then the price will retrace to the key level around which you opened your trade or set your stop loss, and having tested that level, will move on to the price you want to achieve.

If you’re using a trailing stop – you’ll get knocked out every time this happens – only to watch the price then move on in the direction you’d been expecting it to. And you’ll quickly discover just how regularly this happens.

Applying trailing stops safely

So, how can we use trailing stops to let our profits run, without increasing the risk of getting stopped out?

The truth is that any time you tighten in your stop loss, you are going to increase the chances of getting stopped out. What we need to do is balance the relative pros and cons.

For that reason, I will not use a trailing stop when I first open a trade. The chances of a rebound are simply too great.

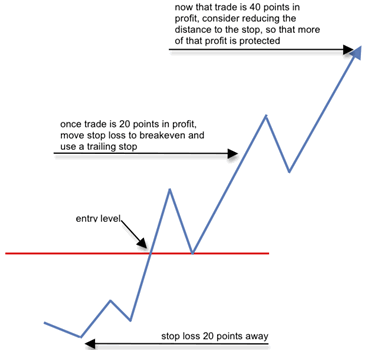

Instead, I’ll wait until I’m sufficiently in profit to move my stop loss up to breakeven to secure some profit, and change that stop loss into a trailing stop.

And the further into profit my trade moves, the more defensive my use of a trailing stop can be.

Here’s an example of how it might work…

We can increase the protection on our profits by reducing the distance to the stop, and also by reducing the increments in which your trailing stop moves.

So, as my profit levels increase, the way I play my trade becomes more and more defensive. And I’m able to follow that famous trading maxim: “cut your losses and let your profits run” by doing nothing more taxing that hitting a few buttons on my spread-bet platform!