There are a number of things that stand in people’s way when they want to make money from the financial markets…

There are a number of things that stand in people’s way when they want to make money from the financial markets…

But one of the biggest hurdles is the belief that trading should be left to the ‘experts’. To the people who know the difference between a re-hypothecated derivative and, err, their elbow…

There’s a huge industry built up in trying to keep the ‘little guy’ on the edges of the financial markets – sure, you can pay for someone (yes, one of those experts) to manage your money, or you can muck about with buying and selling a few shares, or dabble in spreadbetting…

Just as long as you leave the serious stuff to the experts.

Right?

In fact, it couldn’t be more wrong.

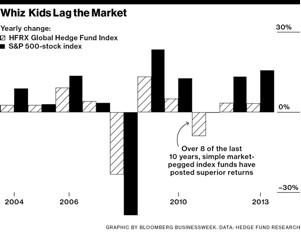

The cover story for last week’s Business Week was ‘Hedge Funds are for Suckers’ – a withering look at just how little money these high-flying experts actually make for their clients.

Despite some golden boom years, hedge funds simply don’t make the kind of stellar profits we associate them with. The big players, like George Soros and James Simons have stepped out of the industry, and the famous John Paulson, who beat hedge-fund records in 2010, and went on to lose 51% in 2011 and 19% in 2012.

Of course, all funds will have good years and bad years, but there’s no consistent sign that these funds are out-performing the markets.

The truth is that these exotic investments are over hyped and over-priced.

The fees charged are ridiculous, and the performance is mediocre at best.

And I’m 100% convinced that any ordinary investor out there can beat hedge-fund returns into submission over the next 12 months.

You don’t need to be an expert – but you do need to think smarter than the next guy.

And I have some very exciting suggestions coming up of how you can achieve this.

Next month I want to show you a trading technique that puts the little guy right at the heart of the best trading opportunities in the market – without any of the hedge-fund expenses, and without trading complicated exotic markets.

There won’t be a re-hypothecated derivative in sight – I promise!

This is a trading technique I’ve been following for some time now, with great interest. To be honest, the returns were looking so positive that I was suspicious. However, my testing is showing that this technique just seems to be getting stronger and more successful, and I really think that now is the moment to be getting on board.

I just want to collect a little more data, and as long as I’m happy with that – I’ll be revealing all the details next month.

In the meantime, I want to look at one of the crucial factors that hedge-fund investors are great at ignoring – costs. It’s why so many rich people throw their money away on hedge funds, when they could be spending it on their yachts.

Costs are one of the unglamorous, dull sides of investing. And working out the most cost-effective way to trade can feel as mind-numbing as trying to work out the cheapest place to buy your gas and electricity from.

But it needn’t be like that.

This checklist will not only save you money on your trading – it will also improve the success rate of your trades

I know that’s a bold claim – but this really can make a huge difference to your profitability. In fact, it can make the difference between a profitable strategy and a failing strategy…

1. What spread is your broker charging you? Can you get it cheaper elsewhere? Many traders shrug their shoulders at the odd point here or there, but this is serious stuff… For every point your broker charges, that’s an extra point the market has to move before you can make a profit.

So, for example, if your trades are aiming to make 20 points profit each, and you manage to find a broker who charges you 1 point less on the spread – not only have you just boosted your returns by 5%, you’ve also made each trade 5% easier to win, so you should expect to see a significant improvement on results.

2. Are you scalping small profits on short timeframes? If so, remember that this is one of the most expensive ways to trade. The smaller your target, the greater the percentage of your profits you’re spending on costs. If you’re scalping 10 points at a time, and paying 1 point to your broker – your broker is making your job 10% harder.

Consider looking at longer timeframes – the same strategy you’re using may be transferable. By looking for bigger moves, your broker won’t be eating so much of your profits.

3. Are you paying a 10-point spread to trade the Nikkei? Or 5 points to trade the Canadian dollar against the Yen? Too many traders are lured into exotic markets, when there are plenty of great markets offering fantastic market moves that can be trade very cheaply. Would your strategy work just as effectively on a cheaper market? If you can find somewhere to trade where you’re only paying 1 or 2 points on the spread – you can boost your profits significantly.

4. If you’re running positions over several days, rolling charges (i.e. the price your broker charges to run your trade over to the next day) can be very high. It’s important to shop around – some companies charge twice as much as others to roll trades. It’s also worth looking at trading futures contracts instead, where the rolling charges are already built into the spread price.

Again and again I see traders who are oblivious to the devastating effect that costs are having to their profitability. I urge you to take a look at how much you’re paying to your broker – this is one trading quick-fix which I’m 100% confident will boost your profits.

I hope to be bringing you a more detailed breakdown of which brokers offer the best services for which types of trading over the coming weeks, so please watch out for my full report on this.