In the face of bad news after bad news… equity markets tumbling… the safe-haven dollar surging… traders are still managing to find something to be optimistic about…

In the face of bad news after bad news… equity markets tumbling… the safe-haven dollar surging… traders are still managing to find something to be optimistic about…

I’m not just talking about Christmas here – it’s the anticipated December effect on the stock markets, which historically sees markets rise in the last month of the year.

And sees investors rushing out to snap them up, ready for the New Year.

However, we’ve now just 9 shopping days to go on the equity markets for this “effect” to kick in. Is it possible that Santa won’t be coming to the stock markets this year?

Whatever happened to the December effect?

After a positive start to the month, the Dow Jones fell for 3 consecutive days, Monday, Tuesday, Wednesday this week, falling back below the significant 12000 level.

Yet, apparently traders are still in the mood for some shopping…

Despite reports predicting a global economic slowdown, many still expect the stock market to finish the month in positive territory, and they’re using the recent dip as a chance to buy shares at discount prices.

Why are traders apparently sticking their fingers in their ears and humming “Jingle Bells” while the global economies collapse around them?

Well, they may have history on their side, as December has traditionally been favourable for equities in both good and bad years – a phenomenon known as the “December effect” or the “Santa Claus effect”.

There are a number of theories behind this. In part, tax considerations are to blame, as traders delay selling winners in order to delay capital gains taxes for another year. Plus, traders are buying in anticipation of the January effect, which sees an injection of funds into the market. Perhaps, there’s also a bit of an optimistic mood at this time of year – or perhaps it’s just that the pessimists are all on holiday!

If we take a look at the Dow Jones for the second half of this year, we can see quite a story unfolding…

Not since the 2008 stock panic have we had such a volatile time on the markets. But, since the US Congress failed to achieve a proper debt deal back in August, and the Standard and Poors downgrade that month, the net result looks like some higher highs and higher lows…

It looks like a very tentative uptrend. And many are predicting a late surge this month.

The Grinch that could ruin Christmas

There is a potential lump of coal in the stocking of our Santa effect… the dollar.

A rally on the dollar will seriously dent the equities markets.

If the equity markets are weak, money floods into the safe haven of the dollar (and the dollar strengthens). If the equity markets are strong, money deserts the dollar (and the dollar weakens).

And that’s exactly what we’ve been seeing this week.

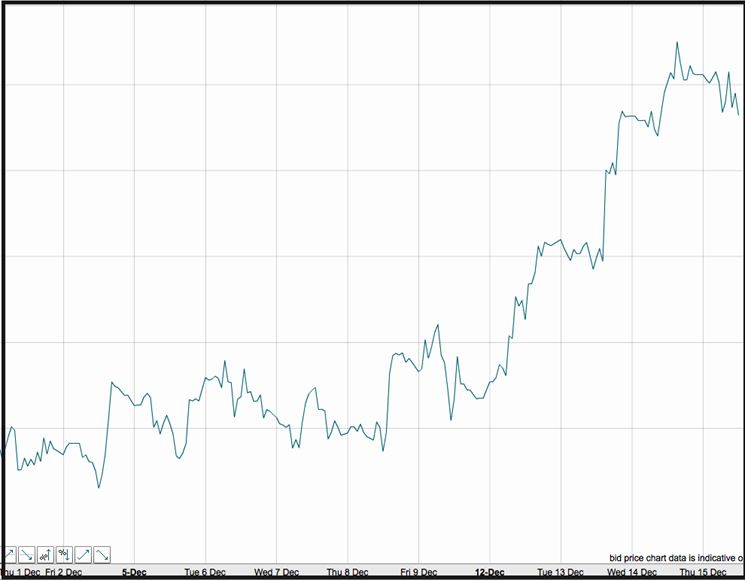

So, while the equity markets have been struggling this month, this is what’s been going on with the Dollar…

If you’re a trading across different markets, it’s very important to be aware of this correlation between equities and the dollar. Otherwise, you may find yourself unintentionally doubling up on your risk if, for example, you’re long on the dollar and short on the Dow Jones at the same time.