While you may feel comfortable trading the dollar… or buying shares on the FTSE 100…

While you may feel comfortable trading the dollar… or buying shares on the FTSE 100…

When was the last time you bought live cattle?

Or platinum?

Well, whether you’ve dipped your toes into the commodities markets before or not, there’s no doubt you’ll have heard a lot of hype about them in recent years.

Commodities are a huge, fast-paced, dynamic market.

These are the raw materials that people all around the planet rely on – the energy, metals and agricultural resources.

Trading commodities is exciting stuff, and – while I know that I won’t have a lorry load of “lean hogs” or cocoa beans turning up at the back door – it still feels more tangible than anything the forex markets or stocks and shares can offer.

That’s the beauty of trading commodities – sure, prices go up and down (that’s how we can make money from them), but they don’t depend on the business strategies of one company or the fiscal plans of one nation. Gold isn’t going to evaporate into thin air anytime soon, and the population of the planet aren’t going to suddenly stop needing food.

Unlike the equities markets, where companies get bigger or smaller according to the strength of their products, the economy or the skills of their CEO, commodity prices are driven by supply and demand.

When there’s more demand than supply (or more demand is predicted), the price will go up. If demand tails off, then the price will go down.

Starting in around 1999/2000, many countries, which had previously had little demand for metals and energy, began huge manufacturing operations, creating a massive increase in the demand for metals and oil. This sparked a bull market for commodities, which saw the value of previously unremarkable metals like copper and zinc skyrocket.

This big surge in value is what’s led us to where we are today, with metal being stripped from church roofs, and people knocking on doors, trying to buy your old gold jewellery.

While this bull run has slowed along with the global economic slowdown, if there’s one thing that traders have learned in the last 5 years, it’s that we don’t need markets to be going up to be making money from them.

All we need is for markets to be moving – and commodity markets certainly do that!

In fact, one of the world’s leading providers of exchange traded commodities is predicting 2013 to be a big year for commodities, with senior investment professional across Europe increasing their allocation to commodities. Global growth is showing signs of recovery, with the US and China leading – and commodities will inevitably be beneficiaries of this.

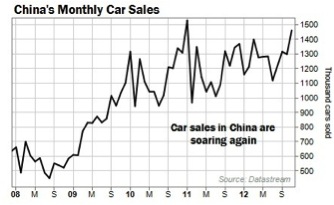

Take a look at this chart showing car sales in China…

It takes coal, oil, iron, copper, palladium and more to build cars – all the kind of demand that can pull commodities prices higher.

The big commodities story is far from over.