As traders, we’re always being told not to let our egos get in the way of trading.

As traders, we’re always being told not to let our egos get in the way of trading.

We need to be calm… removed… disciplined… (a bit like robots).

But, let’s face it, we’ve all got egos (admittedly, some of us have bigger ones than others!), and they can get us into trouble with our trading. When we hold on to losers because we don’t want to accept that we got it wrong… or we trade because our “gut” tells us it’s the right thing to do… or if we believe we can judge a market top…

All these are bad, ego-led trading decisions.

However, if we can indulge our egos with some positive trading methods, then perhaps our egos won’t have to resort to bad habits!

This week I want to look at a positive trading technique that will make you look like a trading genius, even when the market moves against you…

A disciplined way to take profits early

The technique I’m talking about is selling (or buying) half – i.e. closing out just half of your position.

It works something like this…

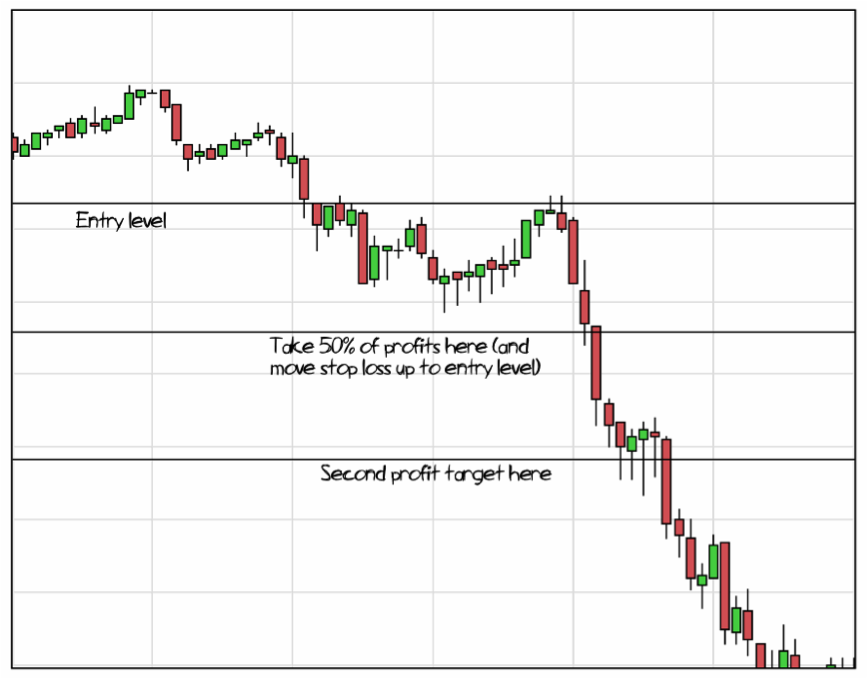

When I enter my trade, I set myself two different profit targets. When the first target is hit, I’ll close out half of the trade, taking 50% of my profits.

For the remaining 50% of my stake, I’ll leave that to run to my second profit target, with a stop loss moved in to my entry level.

As you can see, in this example, I’ve managed to secure a profit from the first move. Then I’ve protected 50% of that profit by closing out half of the trade. The market then continued to move in my favour, so the second half of the trade ran to my second profit target.

By also moving in my stop loss to the entry level, I can protect the second half of my trade from losses (worst case scenario is that the second half results in a breakeven trade, with an overall profit from the first half of the trade).

The result is that (while I could have made more if I’d let the whole trade run to the second target) I’ve secured myself a profit, I’ve been cautious, I’ve even take profits early without having to feel guilty about it – and I feel like a trading genius!

Give that trader a pat on the back.

But what about when it goes against me…

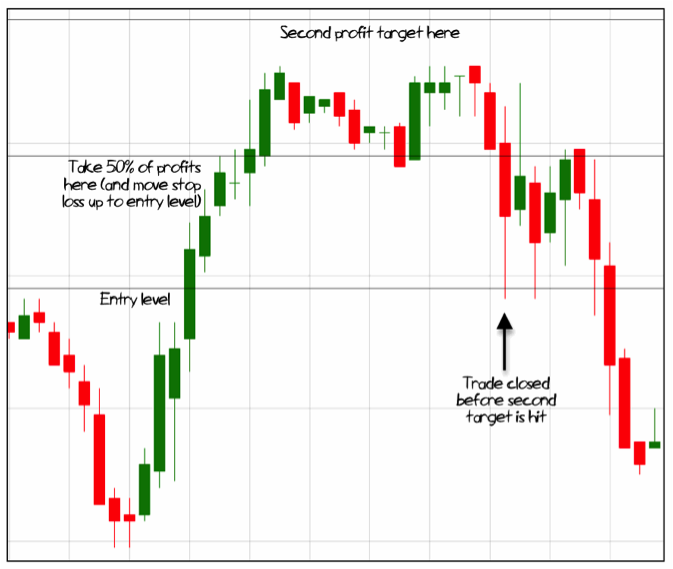

In this second example, the market retraces and knocks out the second half of my trade…

Here, I’ve secured profits at my first profit target, but the price then fell back, meaning the second half of my trade closed out at breakeven, failing to reach the second profit target.

So, even when the market has moved against me, I’ve got a profit in my pocket, and I’m still feeling like a trading genius!

(There are no rules about how much you close out at the first level – it could be 50%, 30%, 20% – whatever suits your plan. Remember, the less you close out, the more aggressive you are being.)

The flipside

Of course, while I’m busy massaging my ego, I may fail to notice the effect this technique has on my profitability…

Closing out half of your trade to take partial profits won’t necessarily make your long-term trading more profitable – it should increase your percentage of winners, but the size of those winners will be smaller.

Plus, if you also move your stop loss level up to breakeven, there will be trades that you lose, which may have gone on to win with a wider stop level.

What it does do, however, is it gives us the security of knowing we’ve some profits secured (and like most types of insurance policy, it usually comes at a price). But by boosting our percentage of winning trades, it can help us to maintain a positive attitude to trading (I’m talking about our egos here again) – the importance of which shouldn’t be underestimated.

The practical stuff

When setting two profit targets for a trade, I personally find it simplest to open two separate trades, with different profit targets for each. When using multiple orders, be careful not to increase your risk levels, because both trades can still go against you before the first profit target is hit. Each trade should be opened with half the stake that you’d usually use.

In the next seven days…

Next week sees the world’s greatest human annual migration, as the Chinese head home for New Year celebrations. Markets in mainland China, Taiwan and Vietnam will be closed for the whole of the week for the Lunar New Year holidays. The market in Hong Kong will be shut from Monday through Wednesday. Commodity markets, in general, tend to go quiet over this period.

This should leave investors plenty of free time to fret about the state of the Eurozone.

Production numbers on Wednesday are likely to show a severe pullback in the industrial sector. And the GDP estimates out on Thursday are expected to show that it fell by 0.4 per cent in the fourth quarter, the third successive quarterly drop.

For the UK, the main data will be the inflation figures on Tuesday. These are expected to show little improvement, and Friday’s retail sales numbers will demonstrate the effect this is having on consumer spending.

For the US, we have retail sales, industrial production and the Empire State manufacturing index, but the big story for traders comes on Friday, with the TIC long-term purchases, showing how much money is pouring into US equities.

One final thing to watch is the Japanese GDP figures and the Bank of Japan monetary policy meeting on Thursday.