Take Advantage of a 2:1 Risk Reward With an Elliott Wave Approach to the FTSE

Take Advantage of a 2:1 Risk Reward With an Elliott Wave Approach to the FTSE

Mark Austin is an independent trader who is living the dream of trading for a living from sunny Thailand. Mark provides a number of services from systems to seminars. Over the last few months I have been focusing on his FTSE service which offers spread-betting tips, market commentary and binary betting ideas.

Mark is a former associate director of a major UK bank who used the credit crunch to quit the rat race and trade for a living from Koh Samui in Thailand. After a period of successful trading, Mark set up his trading service which came to my attention via John Piper. John is a trader I hold in great regard and judging by some of the analysis I’ve seen, the two traders share a similar analytical approach with regards to Elliott Wave analysis. It’s not something I’ve ever taken to myself, but it appears to work for John.

Mark focuses exclusively on the FTSE 100, a single-minded approach I have to admire.

The service

I have been monitoring the FTSE service since May and while this is not a particularly long time, it has allowed me to sample the service through some relatively benign and manic market conditions. It has also allowed me to determine that the results for the service are being reported accurately and while I can’t vouch for results prior to May, I’ve seen no red lights so far.

The FTSE morning report usually arrives before 8AM each day, giving you enough time to assess the market before it opens.

This report usually provides some commentary on the current market conditions with a heads up on potential trade set ups including binary bets. The analysis is based around the Elliott wave so may be a little hard to understand initially, but you’ll get the gist quickly enough.

There are three main types of trade set ups:

1) Binary trades: These types of bets are not provided every day, but can be a neat way to trade the market as they offer a fixed reward or loss. There are various binary trades that I’ve seen with the simplest being the likes of FTSE to finish up, which usually have a price as low as 5.0, offering you a reward of 95 points, risking just 5.0.

2) Magnet trades: These form the mainstay of the advised trades with the magnet attracting a trades profit target. You are then given a heads up on when/if the trade might be triggered with SMS alerts if the trade actually goes ahead. All trades have stop losses and profit targets.

3) Other trade ideas: Within the analysis you are provided with some more long-term swing trade ideas which don’t form part of the official advised trades.

Trade set ups are clearly labelled each day as the following example shows from the 18th of August:

Trade Set ups

CURRENT FTSE 5271

MAGNET – It stands at 5310 – If we open above 5282 buy the market. Given our analysis the stop is tight at 5270. Target 5310 for half profits.

SWING TRADE – If we break below 5265 today then this confirms a move towards 4600 and I will look to go short on the next pull back. Our stops would be 5381. If you are short already exit if we don’t break 5265 at the open and move above 5282 instead.

You are then provided with a number of updates throughout the day depending on market activity. If you’ve been on one of Mark’s seminars it appears these updates would be useful for triggering your own trade ideas.

Mark also sends out charts, again with an Elliott Wave slant, which I have to say have been quite accurate. The following chart was sent on the 18th of August showing an hourly chart of the FTSE 100.

Performance

With any tipping service, it’s ultimately the performance that matters and, so far, Mark has done an excellent job here.

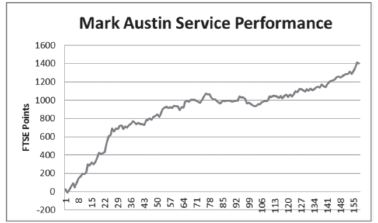

Since inception, the equity curve looks to be rather healthy with just over 1400 points profit returned to date. The bulk of these profits have been made from the spread-betting trades.

The monthly breakdown is fairly consistent, but it is worth noting that the first four months account for around half of the profits generated to date with May 2010 making 360 points alone. I cannot vouch for these months, unfortunately.

There was also a flat period between November and February which saw little progress made in either direction. It some ways, this is encouraging to see as a relentless upwards curve is usually either suspicious or unsustainable. It also shows an ability to step away from markets when they are not favourable for a particular strategy, with the underperformance being primarily due to less trades not bad trades.

In the months that I have been monitoring the service, Mark has notched up 344 points profit, a fine achievement given the market conditions.

Analysing the trades, it’s clear that results are not down to a few runaway winners. The risk reward looks sensible with the average profit being 15 points compared to the average loss of -6 points. This greater than 2:1 risk reward more than makes up for the sub 50% strike rate. The ratio has also remained consistent with early trades and recent trades showing similar performance levels.

The returns from binary trades have tailed off, which isn’t entirely a bad thing as it’s the one area I had problems with. The binary prices are based on the FTSE but also the weight of money going down on those particular bets. It seems that sometimes Mark’s trades can shift the binary prices even when the underlying market does not move. This made a couple of trades hard to match, a problem I did not have with the spread-betting trades.

The bottom line

As trading advisory services go, I like what I’ve seen here. Mark’s track record so far speaks for itself, though I can only vouch for what I’ve seen since May. One comfort is the FSA authorisation provided through t1ps.com, a reputable share tipping company. You’ll certainly need an account well in excess of £1,000 to be able to make this worth your while, but the price of £57 or £28.50 for the first month shouldn’t break the bank.

Thumbs up from me.

WRP Ratings:

Value For Money: 4/5 – Price seems about right given the performance.

Profit Potential: 4/5 – Excellent to date.

Ease Of Use: 3/5 – This is not “set and forget” you

will need to be able to exit trades throughout the day.

Longevity: 3/5 – So far so good.

WRP overall rating: 4/5 – Good profits in difficult markets.

Contact Details:

Mark Austin Trading Website: www.markaustintrading.com/ftse-service.html

Cost: £57/£28.50 for first month.

Audience: FTSE spread bettors.

Level: Beginners upwards

Location: UK-based traders.

Category: FTSE trading signals

Take Advantage of a 2:1 Risk Reward With an Elliott Wave Approach to the FTSE

Take Advantage of a 2:1 Risk Reward With an Elliott Wave Approach to the FTSE