Much of the central bank news this week has focused on the will-they-won’t-they debates from the Bank of England and the European Central Bank.

Much of the central bank news this week has focused on the will-they-won’t-they debates from the Bank of England and the European Central Bank.

But Tuesday saw a surprise pulled out of the bag from a bank on the other side of the world. Markets widely expected the Reserve Bank of Australia to cut rates from 4.25% to 4.00% on Tuesday, but they surprised everyone by holding rates steady.

If you’re not familiar with the Australian dollar, or Aussie as forex traders call it, you might be raising your eyebrows at that 4.25%. It’s a far cry from the interest rates we’re used to in Europe and the US, and no, I haven’t put the decimal point in the wrong place. Among major currencies, the AUD is well known for its high interest rate, which makes it a popular choice among traders for a “carry trade”.

How the Aussie carry trade works

The carry trade used to be serious business for fundamental traders.

A major indicator that forex traders look at is interest rates – moves in interest rates can weaken and strengthen currencies. High interest rates (which can be detrimental to the equities markets in a country, because of the cost of borrowing) can, conversely make that currency attractive to currency traders.

In 1999, when Japan slashed its interest rates to zero, this was big news for those investment banks using what’s called a “carry trade”.

This is how it works… The trader borrows money on the currency with the low interest rate, and invests in the currency with the high interest rate. So, you could borrow on a low rate from Japan, and put your money on deposit in Australia, at 4.25% – and pocket the difference.

Sounds simple – but then there’s all those other economic and political factors that can get in the way. A quick look at a historical chart for AUD/JPY will show you just how tumultuous this trade can be.

These days, with quantitative easing and ultra-low interest rates in Japan, the US and the UK, there’s plenty choice of places for investors to take their money from. With these meager yields in their own countries, great herds of investors are moving their money in search of better returns.

But these trades are often described as “picking up nickels in front of a steamroller”. Carry trades involve a huge level of risk – they are also long-term commitments and require a lot of funds in order to give yourself the relative safety of diversification.

The biggest risk is that the currency exchange rate moves against you, with the higher-interest-rate currency suddenly devaluing.

Running with the trend

What’s caught my eye about the Aussie, however, is this on the 4hr AUD/USD chart …

Nice, neat trending channels like this are few and far between at the moment. The way we trade a channel like this, is to look for buying opportunities when the price is down near the lower trend line, so that we can pick up any long trades, in the direction of the trend.

As you can see, above, each time the price has come close to or touched the support line, it has moved up with some momentum.

Obviously, you want to catch these moves as early as possible to make the most money, and a good way to do this is to shift your chart to a shorter time frame, looking for signals of a change in trend.

Background to the Aussie

But before you jump into trading a new currency, it’s important to understand a little about the factors weighing on it – in particular, about the correlations it has to other instruments you might be trading at the same time.

If you don’t understand these correlations, you can easily find yourself doubling up your risk.

The Australian dollar is closely allied with the price of gold. Australia is the world’s third largest producer of gold, with gold making up 55% of their total exports. So, when the price of gold goes up, the Aussie tends to follow; and when gold falls, the AUD falls too.

The economy is also driven significantly by the price of commodities in general, and by global demand for commodities – specifically, Chinese demand. So, when Chinese growth forecasts look upbeat, the AUD will strengthen. And when negative news comes out of China – the AUD falls back.

But Australia’s economy is not that straightforward. Despite all the tales of economic woe, its resource sector economy has been ramping up. The resource sector does not just mean miners and oil drilling companies, but also all the engineering and construction companies, the equipment manufacturing businesses, the providers of accommodation, flights, beers and whoever else in remote Western Australia and Queensland gets a piece of the cash that goes out to mining employees each month.

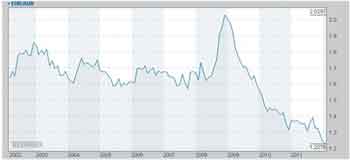

Beyond this link to global economic strength and Chinese growth, AUD correlations to other currencies are a little complicated. The Aussie is not part of the dollar index (this is based on the euro, yen, pound, kroner and Canadian dollar). So, as the value of the dollar has grown, against the slide of the euro, we’ve seen little knock-on for the Australian dollar, which has remained relatively solid. Although what is has done is push the EUR/AUD to ridiculous levels, as this ten-year chart shows.

With the Australian dollar strengthening against the euro at this rate, we could soon see every Aussie trading in their Ute for a BMW!