Forex traders can be a perverse bunch – they can thrive on a news story, whether it’s good news or bad news.

Forex traders can be a perverse bunch – they can thrive on a news story, whether it’s good news or bad news.

And while they may curse central banks who jump in to manipulate prices, plenty of forex traders have done very well out of the currency wars going on in Asia.

It’s been a few months since Maven has taken a hard look at the yen – and a lot has happened in the meantime…

The Japanese Yen has been a big money-spinner for traders in recent years – and there’s every reason to believe that it will continue to be so. As long as you’re on the right side.

The back story

Back when the financial crisis struck in 2007, investors began piling their money into safe havens, desperate to get away from the failing euro. And one of those safe havens was the Japanese Yen.

This in-flux of money has driven up the value of the yen – and had a devastating effect on Japanese industry.

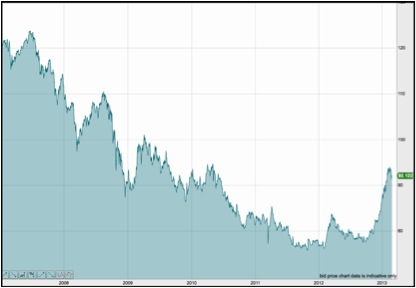

Back in 2007, the Japanese could get around 120 yen to the dollar – a situation which put them at a huge advantage when exporting around the world. Japanese exports seemed cheap to the rest of the world.

Scroll forward to the beginning of 2012, and you’re getting around 75 yen to the dollar. Japanese exports had rapidly got very expensive.

Of course, we can expect currencies to strengthen as economies grow, but the Japanese economy hasn’t been growing. So the strength of the yen isn’t being driven by anything positive going on in Japan – it’s purely caused by the relative weakness of other currencies.

And it’s been causing the Bank of Japan serious problems.

Here’s a chart showing the USDJPY from 2007.

The value of the dollar against the yen has massively depreciated. And against the euro, the yen has done even worse – almost doubling in value between 2008 and 2012.

So, what’s been going on since the end of last year?

Abe’s masterplan

As you can see on the chart, since the end of last year, the strength of the yen has been falling off.

In December, the Liberal Democratic Party won the elections, and Prime Minister Shinzo Abe came to power. Abe has been determined to bring down the value of the yen – and so far, his aggressive monetary easing (upping the stimulus to 76 trillion JPY) has been having a big effect.

And next on Abe’s wishlist is to increase their inflation target to 2%, in a bid to combat years of deflation.

Can devaluation work?

However, the results (or non-results) of the Italian elections last weekend have shown just how fragile this devaluation policy is. Fresh fears of a crisis in the Eurozone sent investors straight back to “safe” currencies like the yen.

Monday saw weeks of hard work in devaluing the yen knocked out in a single surge on the currency, as the value of the yen against the dollar rose by around 3%; and by more than 4% against the euro.

Traditionally, currency devaluation just doesn’t work – the Japanese have been trying this for years, with no long-term success in stopping the tide. So, why should it work this time?

Add to this the Fed’s own policy of devaluation, and we’re stuck in a race to the bottom of who’s devaluing fastest (or this week).

Plus, Japan’s export market is heavily dependent on imports (largely oil and gas), so a weakening yen won’t please everyone in Japan.

Perhaps we should balance the success that Abe has had so far with the money that’s been pouring into stocks in the same period. If the market doesn’t feel the need for a safe haven – then maybe the stimulus will work. If the market gets jittery – as it did on Monday – everyone wants a safe haven (and no one cares what Shinzo Abe is doing to try and stop them).