It’s vital that you know this simple trading rule if you want to avoid the mistakes of the worst traders – and enjoy the successes of the best.

It’s vital that you know this simple trading rule if you want to avoid the mistakes of the worst traders – and enjoy the successes of the best.

In a moment, I’ll explain exactly how the ‘rule of intent’ works, but first I need to look at what can happen if we go bargain hunting in the market …

Three-for-two offers have a lot to answer for

I know that Mrs Maven isn’t alone in being a sucker for a three-for-two offer. In fact, we may well need to build a larger kitchen at Maven Towers just to fit in the bags of flour… kilos of pasta… and the cascade of Penguin biscuits that fall on me when I open a cupboard.

But when you’re consuming a product, there’s nothing wrong with hunting down the best deals – or grabbing them when they come along.

It’s the same if you need to buy a new dishwasher – why not wait for the sales? Pick the end-of-line model? And then bargain down the salesperson to get a better price?

It’s the sensible thing to do.

So, shouldn’t we snap up a bargain when we see one in the markets?

Here’s another scenario…

You’ve got your eye on a stock called Company XY… You’ve done a stack of research… and you’re feeling really confident that this is going to fly.

So, you take the plunge and buy it at £15.00.

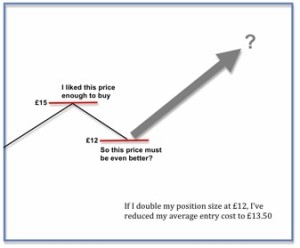

A week later, the value has dropped to £12.00.

You still believe this stock will go up, so surely you should grab this £12 bargain with both hands?

This is where we need to look at the difference between a trade and a, erm, Penguin biscuit.

When we look at the price of food in the shops, or buying a dishwasher, we’re consumers – we’re going to eat that food until it’s gone, or use that dishwasher until it’s broken and we have to buy another one.

But with trades, we aren’t consumers – we’re resellers. Every trade we make has to factor in what someone else will pay for it.

Plus, it should factor in the time you’re willing to wait until you resell.

Adding to a position that has moved against you is called ‘averaging down’ – because you’ve reduced the average cost of that position.

And it’s exactly this ‘logic’ of averaging down has tempted many traders to their downfall.

So why is averaging down so dangerous?

Averaging down smacks of desperation… of a refusal to admit we’re wrong… of over-extending your risk on a trade… and of trading against a trend – all things that break the golden rules of trading.

However, this is where the all-important ‘rule of intent’ comes to play.

A wise man scales in… a fool averages down

Scaling into a trade and averaging down look, to the outsider, like exactly the same thing. Yet, some of the smartest traders I know scale in… and of the traders I’ve know who average down, well, most have blown their funds and fallen by the wayside.

The difference between the two comes down to one subtle thing: the rule of intent.

Scaling in is part of a master plan. It was the way you always intended to play this market.

Averaging down is what you do when you’ve made a mistake and are looking for a way out.

If you’re scaling into a trade, you haven’t put down your full stake at the outset – only a fraction of the full amount you’re prepared to risk on this market.

Let’s say that you’re trading to short the AUD/USD. And you plan to scale into that position every 50 pips. You open your first position (at one-third of your full stake) at 95.8… The second is set to open if the price moves against you to 96.3… and the third portion is set to open if the price moves to 96.8:

By carefully managing entry levels at positions between your first entry and your stop level, you can boost profits and reduce risk.

In the example shown above, one-third of the trade was never triggered – sure, this has the effect of reducing overall profits.

However, the trade also enjoyed a ‘free ride’ of 50 pips on one-third of the trade.

Plus, the overall risk on this trade was considerably lower than it would have been with a full entry at 95.8.

In this way, scaling in can be a powerful tool to improve your risk-reward ratios, and eek extra profits from the market.

However, it isn’t something to be done lightly or on a whim.

- Each entry level should be at a price point that does not negate your original trade idea. (i.e. you should be looking to scale in after some key level of support or resistance has been broken.)

- You should know your risk on each part of the trade – and your overall risk.

- The premise of scaling-in and averaging down is that “I got it right, but was too early”. In trading, you can only afford to be ‘right’ and ‘early’ if you have deep enough pockets and time to wait. If not – ‘right and early’ is generally the same thing as ‘wrong’. However, if you’ve time on your side, and the finances to sit out a correction, then you can afford to be more relaxed about timing. If not, then scaling isn’t for you.

- You should not use scaling in as an excuse to add to losers.

In the next seven days…

I hope that all Maven readers had their trades safely put to bed before Ben Bernanke opened his mouth on Wednesday evening.

As we discussed in Maven last week, there was no doubt that was going to be a serious market mover, and if you’re hoping for some calm after the storm in the markets today, bear in mind that we have the US quadruple witching expiry today – usually a signal for extra volatility.

Now the waiting game has changed from ‘Will they taper QE?’ to ‘When will they taper QE?’ And there’ll be no shortage of investors watching US data like hawks for clues.

And there should be plenty for them to feed on next week… On Tuesday we could be seeing a strong recovery in the US housing market, with sales of new homes potentially up 25% on last year, while the C-S house price index could show an impressive rise of 11%.

Other data they’ll be watching next week are the durable goods orders and CB consumer survey on Tuesday; and pending home sales and personal spending on Thursday.

On this side of the Atlantic next week, the main numbers to watch are the German Ifo survey on Monday, and Thursday’s GDP and current account figures from the UK on Thursday.