PLUS! What Keith Richards, Lewis Hamilton and a Hedge Trimmer can Teach us About Forex Trading

PLUS! What Keith Richards, Lewis Hamilton and a Hedge Trimmer can Teach us About Forex Trading

It’s Wimbledon fortnight and that means one thing at Kato Towers…

Time to cut the hedges!

(I’ll bet that doesn’t sound as tempting as the fresh Strawberries or pitcher of Pimms you probably had in mind!)

Yes, as soon as I see Sue Barker’s cheery smile beam in from SW19 I know it’s time to pick up the phone and call in the services of Ronnie.

Ron’s a full time head-gardener and a bit of a local character.

He works for a posh country house up the road (more like a mini stately home). But also does a bit of moonlighting at the weekend.

I watched him setting up his tools on our yard on Sunday morning. He carefully adjusted the cutting angle of his petrol hedge clippers and swapped the head on his strimmer for a heavier duty one.

And it got me thinking…

These adjustments are an indicator of a professional at work. Someone who really knows what they’re doing.

Ron’s clippers were probably used to trimming off a few millimeters of virgin hedge growth every week up at the big house. Down at Kato’s they needed to tangle with an overgrown thicket of hawthorn.

So whilst the same basic hedge cutting process was being used, to get the best result, some adjustment to Ron’s tool was needed.

And you’d expect nothing less from a professional gardener, right?

Let’s have a look at more current examples of professionals making adjustments:

The Rolling Stones headlined Glastonbury on Saturday night

Keith Richards’s guitar technician had his guitars tuned-in for a morning sound check and at that time, the sun was shining and humidity was low.

But by the time Keith swaggered onto stage that night, the temperature was a good deal cooler and there was moisture in the air. The tension in the steel strings of those same guitars now needed re-tuning to suit the new conditions.

An out of tune ‘Jumpin’Jack Flash’ just wouldn’t have cut the mustard, would you agree?

Or how about Lewis Hamilton over at Silverstone…

On Saturday afternoon he qualified for pole position in the British Grand Prix. But what if weather conditions had taken a turn for the worse by the time of the big race on Sunday?

I don’t think his team would send him out on the same kind of tyre he used in a sunny Saturday qualifier if Sunday’s Grand Prix kicked-off in monsoon-like conditions.

They’d send him out on whatever tyre gave Lewis the best chance of winning. In this case it would mean using a completely different type to the ‘slicks’ he used on dry tarmac in the qualifying round.

Can you see how prevailing conditions dictate the adjustments professionals must make in their field of expertise?

Professionals weigh-up conditions and tweak their bag of tricks to suit.

Now what about Forex trading?

It’s so tempting to take a completely rigid approach to trading – always looking for the same profit target exit point. Using the same stop-loss position come-what-may…

Because we’re all encouraged to follow a strict, rule-based system, right?

But a bit of forethought and a degree of flexibility in your decision-making can really pay-off.

Here’s a quick example to get you started:

We all know the US employment numbers released on the first Friday of the month is a market-moving event.

You’ve probably noticed the momentum and activity in EUR/USD, GBP/USD etc… start to fall-off in the run-up to that release.

It can sometimes slow things down for days in advance. But even so, things can still go crazy the very second the number is out.

So we’ve got three obvious sets of trading conditions right there:

We’ve got ‘normal’ conditions – business as usual before the market starts to think about the job number.

We’ve got ‘quiet’ conditions as the market holds its breath before the release.

And we’ve got ‘volatile’ conditions at the time of the number.

Would it not make sense to adjust your trading toolkit accordingly?

One way you could do it is by looking for a smaller profit on your trades in the ‘quiet’ conditions. You could also use a wider stop-loss when things explode under ‘volatile’ conditions – or even choose to not trade at all.

But I think to completely ignore the fact conditions change is a mistake. Have a think about ways you could gain an edge when you react to changes in trading conditions.

And if you’re worried about breaking your system’s rules – you can build your mechanism of adjustment right into that system…

This way, you’ll be adjusting your tool like a professional and still following your rules to the letter.

Quick Charting Trick: ‘Mind the Gap’ – How to take a quick profit from missing bits of price data

Price gaps are one of the oldest traded patterns on bar and candlestick charts. The gap is simply an area where no trades have taken place leaving a blank space on the chart.

Remember from physics at school how nature abhors a vacuum?

Well it’s pretty much the same in the markets. There is a very high probability a gap will be filled by later trade because the market just can’t bear not to know what was missed in the way of resting orders.

We’re a bit limited for frequent gap opportunities in the currency markets – they trade 24 hours a day after all, so we don’t get so many good opening gaps like in the equities.

But it’s always worth looking out for opening gaps in the various Forex pairs as they start to trade on Sunday evening. You can then place an order to fade the retest of the gap if you find one.

Here’s a recent opportunity from GBPUSD that’ll show you what I mean:

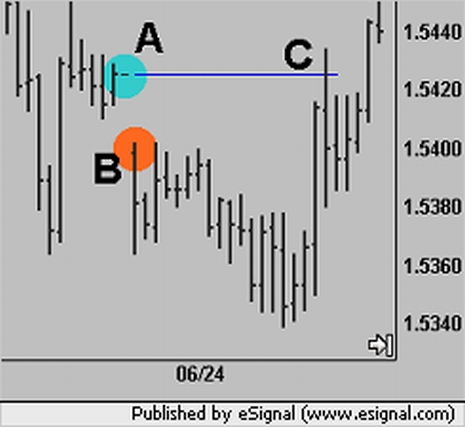

GBPUSD – 5 Minute

A – The little dash in the centre of that blue circle is Friday’s closing price – 1.5425

B – This is the open on the following Sunday evening. The dash to the left of the vertical bar (highlighted inside the orange circle) marks the opening price – 1.5398

This gives us an opening gap of 27 pips – a significant gap the market is sure to be interested in filling. The opportunity is to now place a SELL LIMIT order up at 1.5425 (Fridays close) and look for the market to get back up there to fill the gap, fill our sell order, and bounce back to the downside giving us some profit.

C – Sure enough, the market pops up, bounces off 1.5425 and gives us 50-odd pips worth of action to the downside. For an opportunity like this you’d probably look to take around 20 pips off the table as soon as they were available, with a similar sized stop loss.

As always – use your own discretion and judgement before jumping into any of these trades. You won’t see the gap trades every week but when you do spot one, it can be a very reliable opportunity to get your week off to a flying start.

Be on your toes… Market moving data coming this week: (London Time – BST)

Hang onto your hats – it’s that time of the month again: US Non-farm payrolls!

Before that though, we’re got 4th July holiday in the US (Independence Day) and an early finish from them the day before too (Wednesday 3rd).

Bank of England and the European Central Bank also both have interest rate decisions out on Thursday (when US markets are closed!).

What a strange week we have ahead of us. It could be a wild ride.

Wednesday 3rd July:

13:15 US Nonfarm Employment change (USD)

13:30 US Initial Jobless Claims (USD)

18:00 US US US Markets holiday – early close (USD)

Thursday 4th July:

ALL DAY United States Holiday – Independence Day

12:00 UK BOE Interest Rate Decision (GBP)

12:45 EUR ECB Interest Rate Decision (EUR)

13:30 EUR ECB Draghi speaks (EUR)

Friday 5th July:

13:30 US Nonfarm Payrolls (USD)

13:30 US Unemployment Rate (USD)

I hope you enjoyed this week’s issue. Let me know if you catch any good gap trades on Sunday and until next time…

Happy trading!

PLUS! What Keith Richards, Lewis Hamilton and a Hedge Trimmer can Teach us About Forex Trading

PLUS! What Keith Richards, Lewis Hamilton and a Hedge Trimmer can Teach us About Forex Trading