Zero-risk trading is great for a trader’s ego, psyche, stress levels – and not bad for your trading account either!

Zero-risk trading is great for a trader’s ego, psyche, stress levels – and not bad for your trading account either!

What are free trades?

Free trades are positions with a stop loss set at breakeven (plus the cost of the spread). This is achieved by moving your stop level up to a breakeven point as soon as conditions permit.

Rolling up stops is simple to do in practice – you just plug a different level into your spread-bet platform – but there is a little art and science involved in doing it really successfully.

Free-trade techniques and tricks…

1. Trailing the price

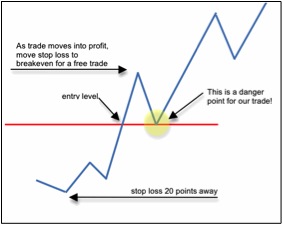

The first way to roll up your stop level is to wait for a significant move to the plus side. So, if we’ve put our stop 20 pips away, and the market has moved 10 pips in our favour – then, we might move up our stop to breakeven.

However, this isn’t a very technical way of doing things. And, anyone who’s looked at a price chart twice can tell you that prices like nothing more than to swing back on us.

This gets to the heart of the problem that comes with “free” trading – if we tighten our stop losses, we naturally increase the risk of them being hit.

So, how can we tighten them up, so that we can enjoy the benefits of zero-risk trading – without ending up with too many trades coming in at zero profits?

For that, we need to think a little bit technically about our stop levels.

2. Dodging the pullback

The enemy of the “free trader” is the pullback. I mentioned pullbacks in my email last week – and here they are again. The pullback can be a trader’s best friend – or worst enemy. It all depends on being prepared for that pullback.

So, what is a pullback?

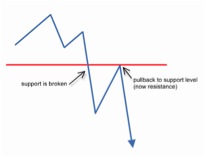

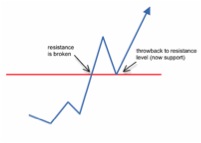

Pullbacks (and their opposite numbers, throwbacks) occur when the price has breached a support or resistance level, and then turns around and bounces back off that level.

In these instances, you can see what this might do to a “free” trader who’s just slid his or her stop loss up to their entry point.

This is why traders entering on or very near support/resistance levels need to be very careful of moving stops to breakeven – this is because your entry point is like a magnet to that price, pulling it back. And we definitely don’t want to position our stop losses on top of a price magnet!

The risk-free trade is best suited to traders who enter trades on a move that is already underway – this means that the price is less likely to turn around and bite them.

However, many of us do enter trades on or near key levels (what are key levels for?!) And we don’t have to forego free trades – we just have to be a little bit smarter about our stop placement …

3. The technical stop

A more orderly way to roll up your stop loss is by looking at technical levels – these may not allow you to move to breakeven straight away, but they can reduce your risk in a steady way that leaves you at less risk of being stopped out by a pullback.

The classic tool for this is the Parabolic Stop and Reverse indicator – pop this indicator up on your chart and it’ll give you a neat little dot, which you can use as a stop level. Many traders use this as a form of trailing stop on their positions.

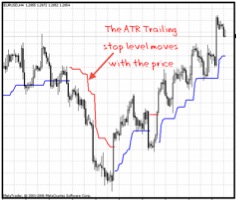

Another technical tool to use is the ATR – the average true range. This indicator is based on the average trading range for a period (over a set number of candlesticks), and can give us a good idea of the size of moves the market is likely to make. This information can then be applied to your chart as an ATR trailing stop.

Another useful tool for day traders uses the key support/resistance levels that got us into the trades as guides for our trailing stops. As ever, we won’t put a stop loss bang on a level of support or resistance – instead, we’ll tuck it safely onto the far side of that level.

In this way, we won’t bring our price up to breakeven – but a few points short of breakeven (not including the cost of the spread). And only when we’ve broken further levels will we feel safe enough to move into zero-risk territory.

Another useful tool for day traders following this technique is pivot points. These give us clear levels where we can expect prices to congregate each day – levels we need to keep on the safe side of. If your trading platform doesn’t offer a tool to automatically put these into your chart, you can find plenty of free pivot point calculators to download from the Internet.