What is “the 1 percent rule”?

What is “the 1 percent rule”?

It claims that in online communities, 1% of users are creators… 9% of users are occasional contributors… and 90% of users are “lurkers” who never contribute.

I’d probably have to place myself in the 9% (I don’t send out a tweet every time I put the kettle on). But I’ll freely admit to doing a fair bit of lurking on other people’s sites.

The 1 percent rule is often cited as a negative thing – that we need to encourage more participation from online communities. However, in my opinion, too much “participation” is what leads to tweets about what you just ate for lunch.

There are plenty of times when the best thing to do is nothing – and that’s particularly true in trading.

Here are two important ways in which we can do more – by doing less.

How a bit of “lurking” can help your trading

I wonder if you’ve ever done this…

You log on to your trading account to place a trade according to your strategy…

There’s no signal…

So, you cruise around the markets, flicking through different instruments and timeframes – looking for a trade…

Sound familiar?

If not, then you’ve more discipline than most.

I know that I’ve done it myself – I’m ready to trade, so I expect the markets to be ready too.

But it’s precisely these “forced” trades that are usually my downfall.

Most of us could do with spending more time watching the markets and waiting patiently – and less time actually in the markets.

“Doing nothing” is as important a part of your investment strategy as active trading. It may not be making you money, but it is actively protecting your funds.

There’s absolutely nothing wrong with a bit of “lurking” around your spread-betting account. And if you really feel you must be doing something – that’s what demo accounts are for!

The financial 1% rule

Financial trading has its own 1% rule – although I often see it pushed to a 2% rule… a 3% rule… and even a 5% rule…

I’m talking about how much of your money is at work at any one time – and how much is doing nothing, sitting in your account.

And the 1% rule states that you will never risk more than 1% of your trading fund on any one trade.

It’s a conservative stance, and one that’s considerably less exciting to follow if you’re used to risking 5% of your pot at a time.

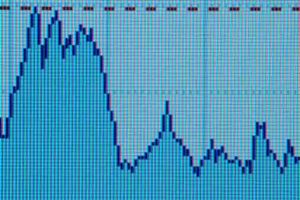

However, it dampens the volatility of your trading fund – you know, those ups and downs that can leave your head spinning or your stomach churning.

Any loss will only ever be 1% of your fund. Follow this, and you’ll find that you care less about whether you’re right or wrong on any given trade, and you’ll naturally start to see the bigger picture – the goal of long-term profitability, instead of sweating the small stuff.

It also means, that you’ll be alive on the next trading day, rather than blown out by a few big losses – and staying in the game is vital if you’re to succeed in your long-term financial goals.

What is “the 1 percent rule”?

What is “the 1 percent rule”?