It’s been an exciting week in the markets.

It’s been an exciting week in the markets.

The drama kicked off last Friday, when the US non-farm payrolls came in below expectations. This sparked a sell-off in the markets.

And the turmoil of European elections over the weekend did nothing to calm traders’ fears.

In France, we’ve the new president Francois Hollande about to embark on a big gamble, which could lead the way to growth or could plunge Europe into financial and political turmoil. This isn’t US-style Keynesian economics – the scale of Hollande’s anti-austerity measures may be popular with voters, but it’s uncharted economic territory.

But France’s anti-austerity programme is small news next to the situation in Greece. A new Greek coalition is still an unknown quantity, and they could well rip up all previous agreements to austerity.

Understandably, the markets have been spooked.

Market Volatility in Action:

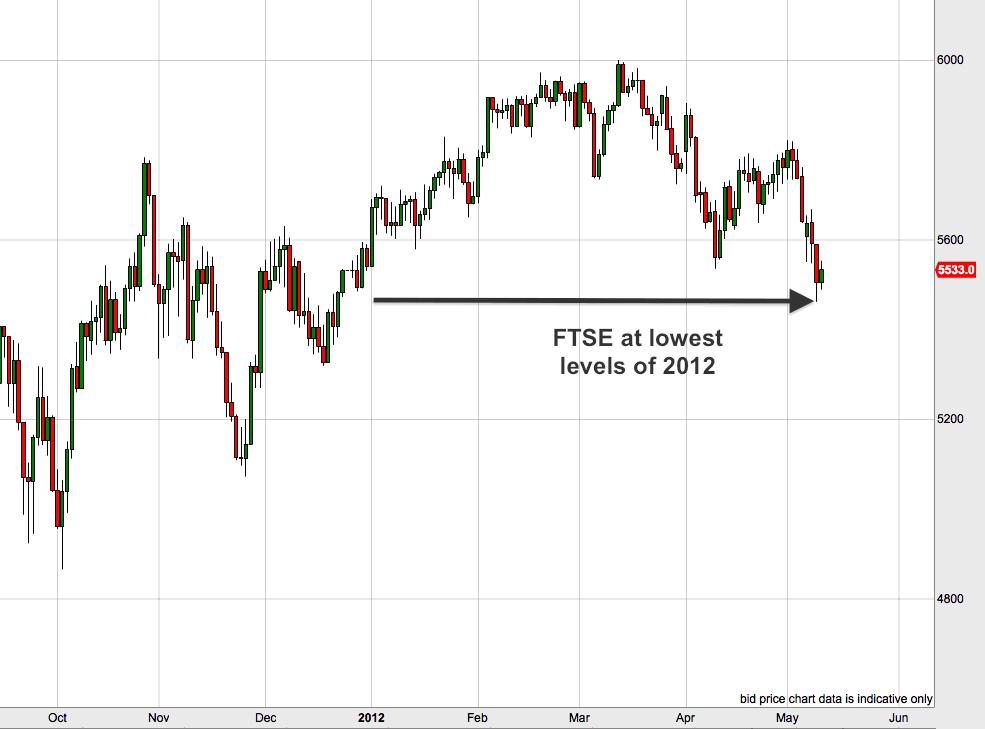

The FTSE is at its lowest level this year.

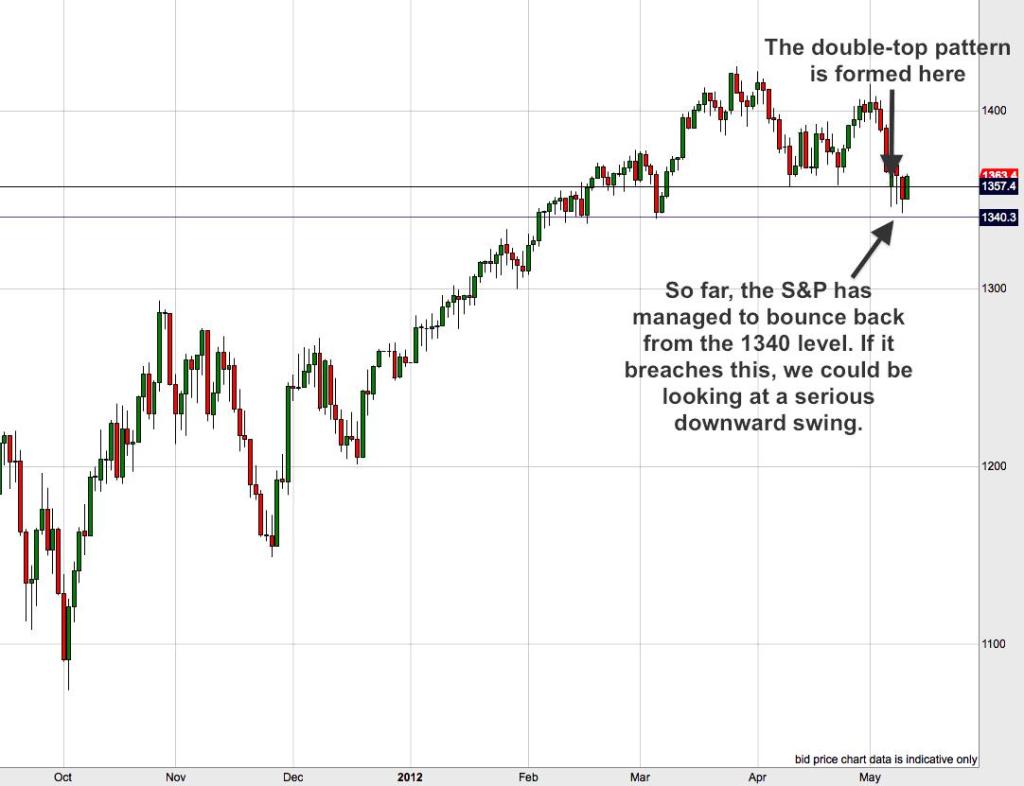

We spotted a potential double top on the S&P last week. This is now fully formed and is currently testing the 1340 level.

The Dow Jones is also close to forming a double-top.

And if you think the equities markets look exciting, take a look at the Euro chart this week …

The Euro had over 200 pips wiped off its value against the dollar between Friday afternoon and Sunday evening, and is continuing to look very weak.

The crisis in the Eurozone is not about to come to a conclusion any time soon. And while this means a lot of pain for member states – it also gives forex traders plenty of opportunities to catch a profit.

Which is why I want to look today at 5 key ways to play volatile markets …

1. Markets tend to rise slowly and fall fast.

For long-term buy-and-hold investors, that can be a scary prospect, but for spreadbetters, it’s good news.

That’s why when we see signals for an impending bear market, traders tend to get very excited. There are big potential profits on the way – and we won’t be left hanging around waiting for them.

2. Don’t expect markets to react to news stories in the way you (or experts) predict.

Often potential good or bad news is already factored into the price you’re seeing in the charts. Let’s face it – traders aren’t living in a bubble and reacting to things as they happen. If you’re reading the papers and listening to the news – you can be sure that they are too.

This is why what looks like good news actually causes markets to fall (as it wasn’t good enough); and vice versa with bad news. So, don’t think you can predict which way the market will go on a news story, because it’s incredibly difficult to judge just how much news is already factored into prices.

3. Re-evaluate your stop losses.

In volatile markets, traders get risk-averse, and a first reaction is often to tighten up stop losses.

This will often work against you, as you’re bumped out of your trades by the increased volatility.

Instead, consider trading with a wider stop loss than you would normally. This will give your trade space to breathe, as the market decides which way it’s going to move.

This does not mean that you should increase your risk. If you widen your stop – you’ll need to reduce your stakes accordingly, otherwise you’re leaving yourself vulnerable.

4. Keep your cool.

If the markets are making you feel nervous with all their jumping around, don’t give yourself sleepless nights. Trading is about making money, not about testing the limits of your blood pressure.

Simply reduce your risk by cutting back on the percentage of your trading fund that you’re risking. (If the markets really are making some big moves, you may find that you can still pick up hefty profits if you manage your trades well.)

5. Let your winners run.

If the market is making big moves, this is exactly the time to hone your skills with trailing stops. Instead of closing out a trade at your profit target, consider putting in a relatively tight trailing stop. This keeps your risk small. If you get bumped out of your trade, you’ve lost very little, but if the market continues to run – you can take advantage of all that lovely movement.