Today, I’ll tell you about silver… the gutsy little brother, often ignored by traders who are dazzled by his shiny yellow sibling!

Today, I’ll tell you about silver… the gutsy little brother, often ignored by traders who are dazzled by his shiny yellow sibling!

Silver has had a pretty tough time recently.

As you can see in the chart below, it had a meteoric rise between mid-2009 and early 2011, but since then the price has dropped back sharply and been stuck in a sideways pattern.

Is it headed down? Or back up?

To better understand what’s been going on in the silver market – and the scale of moves it can make – it’s worth taking a little history lesson …

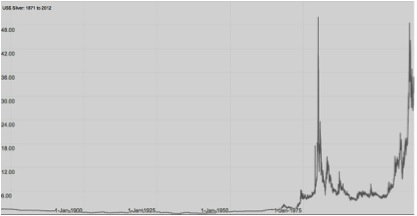

Here’s a chart showing silver prices way back to 1871.

See that big spike in the 70s?

That was caused by the famous Hunt brothers’ accumulation of silver. The price rose almost ten-fold in the space of just a few months – and then fell back even more sharply.

The story is that the Hunt family, Texas billionaires with a string of the finest thoroughbred racehorses, tried to corner the entire market on silver. They were concerned by the money-printing activities of the US government, so decided to build up a horde of precious metal to protect themselves from inflation.

In 1979, the Hunt brothers, along with a group of Middle Eastern investors began buying silver. We’re not just talking about a few bars hidden under the mattress here – before long, they had amassed over 200 million ounces of the stuff – about half of the world’s supply.

When they set out, prices were around $5 an ounce. By the end of the year, the price was near £55/oz. There was a serious risk of the COMEX defaulting, so the Fed set limits on the amount of silver any one entity could hold.

The price began falling fast.

On 25 March, 1980, the Hunt brothers couldn’t meet their $135 million margin call.

And two days later, the price dropped by 50% in one day.

The Hunt family was bankrupt, and had to sell their 580 racehorses, bringing in nearly $47million dollars – a drop in the ocean compared to the debts they had racked up.

Although this was of little interest to the many speculators who lost a lot of money.

So, what about that second spike on the chart?

Well, the more recent spike in silver prices has had a very different cause – the commodities boom that I was talking about last week. Silver was a late arrival to the commodities party, but once it arrived – it really entered into the spirit of it!

Proponents of silver will tell you that this precious metal has an inherent value. While gold’s value is really based on what anyone will pay for it, silver has a number of practical industrial applications, in batteries, bearings, soldering, electronics and as a catalyst.

Demand for silver from growing economies like China, plus investors looking for a hedge themselves against economic uncertainty, led to this big silver boom.

Of course, what you really want to know is which way is silver headed now? Did the bubble burst? Or is this just a correction?

And – just as importantly – when should we make our move?

It can be incredibly difficult to find a balanced picture on the future of precious metals. Buyers of gold and silver are a bit like doting parents who won’t see any wrong in their offspring, in spite of evidence in front of them. (You know, the sort who’ll tell you that “little Johnny is a gentle and loving soul” – while “little Johnny” kicks you in the shins and swears at you?)

Well, too many “silver bugs” will always remain resolutely bullish, even as the value of their investment disappears off a cliff edge!

To really succeed in the commodities market, you need a sound, technical point of view, without the hearsay and the emotions.