My Uncle Chris was an old-school buy-and-hold investor. A few years back, when the value of a stock he was holding suddenly fell by 50%, he was left in deep water.

A good portion of his retirement plans were tied up in that investment.

Should he cut his losses? Or wait (and hope) for the market to come back into favour?

What Uncle Chris did was pour over company reports… read the press… study some technical signals… look at the health of the overall market… and then took a punt…

He just made his best guess. He really didn’t have any other choice.

He was forced into a situation where he had to time the market. He had to make a judgement call: was this the bottom? Would the price keep going down? If so, by how far? And if a recovery was coming, would it be soon enough? And big enough?

You may look at the situation my uncle got himself into as a cautionary tale, about not having enough diversity in your portfolio.

But the truth is that as traders we’re forced into these situations all the time. Situations where we’re just taking a punt.

It might not be for as hefty a proportion of our funds, but again and again we’re making guesses (they may be educated guesses, but guesses none the less) – will the market turn…? Will it keep moving…? How far will it move…?

This is stressful stuff. It’s no wonder I’m turning grey.

I don’t know about you, but I don’t like being in a situation where the value of my investment has fallen, and I’m either stopped out or I’m ‘uhming’ and ‘ahing’ over whether to jump ship or hold my nerve.

And yet, I’ve been in exactly that situation more times than I’d like to admit.

Do I need to improve my market timing?

Or is there an altogether better way to trade that frees us from worrying about timing?

I’m currently following a system that I mentioned last week, which is entirely market-neutral. This means that it doesn’t matter a jot whether the market is about to turn… is going down… is going up…

It’s beautifully stress-free.

And, more importantly, it’s working.

As promised, I’ll be bringing you full details of this technique next week.

But in the meantime, it’s worth giving yourself a quick healthcheck on whether you have a problem with trying to time the markets…

Market timing healthcheck

I expect you’d like to ride all the rallies and sit out the corrections, repeating this process again and again until your pockets are bulging with lovely drawdown-free cash. Right?

Unfortunately the list of investors who’ve accurately timed market tops and bottoms is pitifully short.

And those who get lucky one time… or two times… are very likely to get overconfident, and blow up when they miss the third time…

Mark Matson, a US money manager, likens a market-timing strategy to ‘playing Russian roulette with two bullets in the chamber. The idea that some market timer is going to save you from the crashes while getting you all the upside from great markets is a fantasy’.

Now, all well-trained investors are told the rule: you can’t time the market.

And yet, every time we check our technical or fundamental signals, that’s exactly what we’re trying to do.

The problem with market timing is that we easily slide into what everyone else is doing.

We wait for prices to go up, and buy… When they go down, we sell…

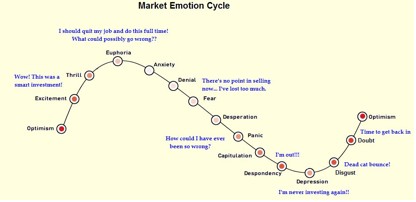

And the result is that we’re forever chasing our tails on the rollercoaster of market emotions…

It is very natural to fall into a pattern of buying when we feel comfortable and selling when we feel uncomfortable. And this is exactly the pattern that leads traders to buy high and sell low.

That’s why it’s important to close your ears to what pundits are saying. And to look at balancing your trading with some market-neutral investments.

And I’ll show you exactly how you can do that next week.